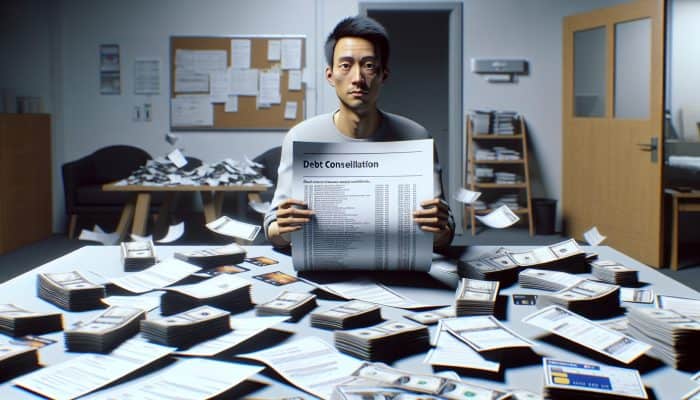

Understanding the Financial Implications of Remote Work on Debt Consolidation Strategies

Evaluating How Changes in Income and Spending Habits Affect Financial Health

The transition to remote work dramatically alters an individual’s financial landscape, particularly in terms of income and spending patterns. As a rising number of professionals make the shift to home offices, they encounter both increases and decreases in their financial commitments. For example, while expenses related to commuting may decline, new costs incurred from establishing a home office can arise. Gaining a comprehensive understanding of these financial transitions is essential for crafting effective debt consolidation strategies. Important financial shifts often include:

- Reduction in commuting costs: Many who work remotely enjoy substantial savings by cutting out daily travel expenses.

- Increased utility bills: Spending more time at home can lead to higher costs for electricity and heating.

- Investments in home office equipment: The purchase of office supplies and advanced technology often requires significant upfront financial investments.

- Higher food expenses: More frequent home cooking can increase grocery bills compared to occasional restaurant visits.

- Opportunities for additional income: Remote work may create avenues for freelance or part-time roles, enhancing overall earnings.

- Changes in employment status: Shifts to contract or freelance engagements can influence job security and the reliability of income.

- Flexibility in working hours: This flexibility can improve time management, positively impacting financial planning.

- Altered disposable income: Variations in income can affect the amount available for debt repayment.

These financial transformations necessitate a thorough reassessment of current debt consolidation strategies. The entire financial landscape can shift significantly, highlighting the need for remote workers to adapt their financial plans to these evolving circumstances.

Evaluating the Availability of Debt Consolidation Services for Remote Workers

The accessibility of debt consolidation services for individuals working remotely presents a multifaceted array of benefits and challenges. While certain elements may enhance accessibility, other factors can create significant barriers depending on personal situations. Key factors impacting access include:

- Geographical location: Some regions may lack local financial institutions that offer consolidation services.

- Time zone differences: Remote professionals with international clients might experience scheduling issues that restrict service availability.

- Availability of online services: The rise of digital platforms has expanded access to a broader range of services.

- Flexibility in working hours: A remote work setup can provide the necessary time to meet with financial advisors.

- Awareness of available options: Many remote workers might not be fully informed about the various consolidation services available to them.

- Credit score implications: Access can be limited by an individual’s credit profile and lender perceptions.

- Technological proficiency: Comfort with digital tools can influence how effectively remote workers explore online options.

- Networks and resources: Access to financial networks can vary, affecting the quality of guidance received.

Understanding these elements can greatly assist remote workers in making informed choices regarding their debt consolidation pathways.

Essential Financial Planning Adjustments for Remote Workers

Shifting to remote work calls for significant modifications in financial planning, which can have substantial ramifications for debt consolidation outcomes. As individuals navigate this new financial terrain, they must carefully evaluate various aspects that can influence their debt management strategies. For instance, the elimination of commuting time opens up opportunities to engage more deeply with financial planning, but it may also lead to overspending as personal and professional lives begin to intertwine.

Effective budgeting becomes increasingly crucial, as remote employees must allocate funds wisely for both regular expenses and debt repayment. Monitoring income fluctuations, especially from variable earnings linked to freelance work, must be factored into their financial planning. Furthermore, assessing the impact of new expenses—such as those associated with home office setups—can complicate financial planning. By aligning their financial strategies with these realities, remote workers can substantially enhance their capacity to consolidate debt effectively.

Expert Perspectives on the Effects of Remote Work on Debt Consolidation

Real-Life Case Studies Illustrating Remote Workers’ Debt Consolidation Experiences

Real-world examples shed light on the varied impacts of remote work on debt consolidation for individuals across the UK. Take Sarah, for instance, a marketing professional who transitioned to remote work during the pandemic. By eliminating commuting costs and gaining newfound flexibility, she redirected funds that were previously allocated for travel towards consolidating her credit card debt. This strategic financial shift enabled her to eliminate high-interest balances sooner than expected.

Another illustration features Andrew, a freelance writer who experienced income fluctuations due to the nature of his work. Initially, he struggled with debt management, but after participating in a financial workshop designed for remote workers, he learned to create a more adaptable budget. By utilizing flexible payment plans, he successfully consolidated his debts without jeopardizing his financial stability.

These case studies emphasize the diverse experiences of remote workers in the UK regarding debt consolidation. Each person’s situation can vary significantly, influenced by factors such as income reliability, spending patterns, and personal financial goals.

Practical Expert Tips for Effective Debt Management

Financial professionals recommend actionable steps that remote workers can take to manage their debt efficiently in today’s constantly changing financial landscape. The initial step involves reassessing and refining budgeting practices in light of the shifts brought about by remote work. This process includes meticulously tracking both fixed and variable expenses to ensure that debt repayments remain a primary focus.

Moreover, remote workers should consider establishing an emergency fund, which can serve as an essential safety net against unforeseen income variations. Setting clear financial goals, such as determining a timeline for debt repayment, can also enhance accountability and motivation.

Additionally, experts advocate for leveraging technology in debt management. Numerous applications are available to help track spending and send reminders for upcoming payments. Engaging with online financial communities can provide support and encouragement, motivating remote workers to adhere to their debt consolidation plans. These practical recommendations can significantly assist remote workers in navigating the complexities of debt management while adapting to their new working realities.

Analyzing Emerging Trends in Remote Work and Their Financial Implications

Current trends in remote work within the UK are significantly impacting debt consolidation strategies. As more individuals embrace remote work, the conventional financial landscape is evolving, necessitating innovative methods and approaches to debt management. Experts analyze these trends to provide insights into potential future practices that may emerge.

A notable trend is the increasing focus on financial literacy among remote workers, driven by the need to adapt to new financial challenges. Many are turning to online resources and courses to enhance their understanding of personal finance management. Moreover, as the number of remote jobs continues to rise, lenders are beginning to adjust their criteria for assessing creditworthiness, potentially improving access to debt consolidation loans for remote workers.

With hybrid work models gaining traction, flexibility in repayment terms is becoming increasingly appealing. Lenders may provide more customized options to accommodate the unique financial situations of remote workers. This analysis of remote work trends highlights how the financial landscape is evolving to better serve a growing demographic of professionals navigating debt consolidation.

How Does Remote Work Influence Debt Repayment Strategies?

Key Effects on Monthly Budgeting Practices

Remote work dramatically alters monthly budgets, which can have significant implications for debt repayment plans. With commuting costs eliminated, many remote workers find themselves with an increase in disposable income. However, this newfound financial flexibility requires careful management to ensure that these funds are effectively directed towards debt repayment.

An immediate consequence of remote work on budgeting is the potential for increased spending on home-related necessities, such as utilities and office equipment. This transition demands a robust budget that accurately reflects both routine living expenses and debt obligations. Remote workers must refine their financial strategies to minimize the risk of overspending, particularly in areas where home comforts might lead to indulgence.

Additionally, many remote employees enjoy increased flexibility in their schedules, allowing them to dedicate more time to financial planning. This flexibility can enhance debt repayment strategies, as individuals can allocate specific hours to review their finances, make payments, and seek expert advice. By adjusting their monthly budgets to accommodate these modifications, remote workers can improve their ability to pay off debts and consolidate effectively.

Enhanced Flexibility in Debt Management for Remote Workers

Remote work offers significant flexibility in debt management, which can be a priceless advantage for individuals striving to consolidate their financial obligations. The autonomy over one’s schedule allows remote workers to create personalized repayment plans that align with their unique financial realities.

One primary benefit of this flexibility is the ability to adjust work hours to accommodate essential financial management activities. Whether it’s meeting with a financial advisor or setting aside time to research consolidation options, remote workers can utilize their schedules to stay proactive in their debt management efforts. This adaptability also extends to establishing automatic payments, which can help reduce the risk of missed deadlines.

Moreover, remote workers can leverage their flexible roles to explore additional income streams, such as freelance projects or part-time jobs. This supplementary income can provide crucial relief in debt repayment endeavors, paving the way for accelerated consolidation. By taking advantage of the benefits of remote work, individuals can develop more effective strategies to manage and reduce their debts.

The Impact of Remote Work on Debt Consolidation Loans

The availability and conditions of debt consolidation loans are increasingly shaped by the rise of remote work across the UK. As more individuals engage in remote roles, lenders are reassessing their criteria and views on job stability, which can directly influence the options available to borrowers seeking consolidation loans.

Remote workers may discover that some lenders are more inclined to consider their applications due to the growing prevalence of remote positions across diverse sectors. However, concerns regarding job security persist. Individuals involved in freelance or contract work may encounter challenges in securing loans, as lenders typically favor the stability associated with traditional employment.

Additionally, the terms of debt consolidation loans may vary for remote workers. Lenders could offer more customized solutions that take into account the unique financial circumstances of remote employees, including more flexible repayment plans. By understanding the changing landscape of debt consolidation loans, remote workers can better navigate their options and secure the funding necessary to manage their debts.

Does Remote Work Influence Debt Repayment Motivation?

The motivation to repay debt can be significantly affected by the dynamics of remote work. Changes in the work environment and daily routines can either enhance or detract from an individual’s focus on debt repayment. For many remote workers, the comforts of their home environment can create a sense of security, which may inadvertently lead to complacency regarding their financial responsibilities.

To counteract potential declines in motivation, remote workers can adopt various strategies. Establishing a structured daily routine that prioritizes not only work tasks but also financial obligations can help maintain focus on debt repayment goals. Furthermore, setting clear, achievable milestones can foster a sense of accomplishment, motivating individuals to stay dedicated to their financial plans.

Engaging with accountability partners, such as friends or family members, can also enhance motivation. By sharing financial objectives and progress, remote workers can sustain a higher level of commitment to their debt repayment strategies. Ultimately, recognizing how remote work influences motivation is crucial for developing effective methods to manage and repay debt.

Transformations in Financial Behavior Due to Remote Work

Changes in Spending Patterns and Their Impact on Debt Levels

Remote work often leads to substantial alterations in spending patterns, which can significantly influence overall debt levels. As individuals adapt to the comforts of working from home, their purchasing behavior may change, directly affecting their financial stability.

For example, while many remote workers save on commuting and dining expenses, they may also find themselves spending more on home office supplies, technology upgrades, and increased utility bills. This shift can result in an overall rise in monthly expenses, potentially worsening debt levels if not properly managed. It is crucial for remote workers to closely monitor these expenditures to ensure they remain within budgetary constraints.

Moreover, the convenience of online shopping may tempt remote workers to make impulsive purchases. Increased screen time can elevate exposure to marketing and promotional offers, underscoring the importance of cultivating disciplined spending habits. By recognizing these altered spending patterns, remote workers can formulate strategies to mitigate their financial impact and focus on maintaining or reducing their debt levels effectively.

Discovering Savings and Investment Opportunities

Remote work presents numerous new savings and investment opportunities that can positively influence debt consolidation efforts. With a more flexible schedule, remote workers can explore alternative avenues for generating income and saving money, thereby enhancing their ability to manage debt effectively.

One of the key benefits of remote work is the potential for reduced daily expenses, such as commuting and professional attire. This newfound financial freedom can be redirected into savings or investments that align with individual financial objectives. For instance, many remote workers are seizing opportunities to invest in stocks or other financial instruments, potentially yielding returns that can be used to pay down existing debt.

Furthermore, remote work allows the time necessary for thorough research into investment options. Individuals can utilize online platforms and resources to make informed decisions regarding fund allocation. By being proactive, remote workers can build a more solid financial foundation, ultimately supporting their debt consolidation efforts.

- Stock market investments: Utilizing extra income from remote work to invest in stocks.

- Real estate opportunities: Exploring property investments through savings accumulated from reduced expenses.

- Retirement accounts: Contributing to pensions or individual savings accounts for long-term growth.

- Peer-to-peer lending: Investing in lending platforms to generate additional income streams.

- High-yield savings accounts: Utilizing online banks that offer better interest rates.

- Emergency funds: Building a financial cushion to cover unexpected expenses without accruing debt.

- Mutual funds: Allocating funds to diversified portfolios for potential higher returns.

- Cryptocurrency investments: Exploring the volatile yet potentially profitable world of cryptocurrencies.

These savings and investment opportunities can significantly enhance the financial health of remote workers, ultimately making debt consolidation more attainable.

Innovative Debt Management Strategies for Remote Workers

The financial landscape shaped by remote work necessitates the formulation of new debt management strategies to effectively adapt to changing circumstances. As remote workers embrace a more flexible lifestyle, they must implement tailored approaches to navigate their unique challenges.

One effective strategy involves creating a comprehensive financial plan that incorporates both short-term and long-term objectives. Remote workers should evaluate their income streams and identify growth opportunities, such as engaging in side projects or freelance work. By diversifying income sources, they can cultivate a more stable financial situation that supports their debt repayment initiatives.

Moreover, employing technology to track expenses and payments can streamline the debt management process. Numerous budgeting applications available today can assist remote workers in monitoring their spending patterns and ensuring they stay on track with their debt repayment goals. By harnessing these tools, individuals can maintain a clearer understanding of their financial health and make informed decisions regarding debt consolidation.

Finally, seeking guidance from financial professionals who understand the nuances of remote work can provide invaluable insights. Collaborating with experts can help remote workers devise robust strategies tailored to their needs, maximizing their ability to consolidate and manage debt effectively.

The Impact of Remote Work on Retirement Planning

Remote work can significantly influence retirement planning, especially concerning its effects on income stability and savings rates. As individuals transition to remote roles, they often face new financial challenges that necessitate adjustments to their retirement strategies.

A crucial consideration is the potential for fluctuating income levels, particularly for freelancers or those on variable contracts. This unpredictability can complicate regular contributions to retirement accounts, requiring a more flexible approach to saving for the future. Remote workers must remain vigilant about their savings rates, ensuring that they prioritize retirement contributions even amidst shifting financial conditions.

Additionally, the shift to remote work may encourage individuals to reassess their long-term financial goals and the types of retirement accounts they utilize. Those who previously depended on employer-sponsored pensions might find it necessary to establish personal retirement accounts, such as ISAs or SIPPs, to continue building a secure financial future.

By proactively addressing these aspects of retirement planning, remote workers can safeguard their financial well-being and ensure they are prepared for the future, ultimately facilitating effective debt consolidation strategies along the way.

Evidence Supporting the Benefits of Remote Work for Debt Consolidation

Research Insights on Remote Work and Financial Well-Being

Research indicates that remote work can positively influence financial health, thereby aiding debt consolidation efforts. Studies demonstrate that individuals working from home often experience enhanced productivity and lower stress levels, which can lead to more effective financial management. This improved mental state allows remote workers to approach debt consolidation with a clearer mindset and increased focus.

Moreover, remote work arrangements frequently result in reduced living expenses, as individuals save on commuting, meals, and work-related costs. This decrease in expenditures enables remote workers to allocate more funds toward debt repayment, facilitating a more effective consolidation process. Overall, the financial health of remote workers tends to improve as they adapt to this new environment and capitalize on the benefits of their circumstances.

As the trend of remote work continues to expand, understanding its implications for financial health becomes vital for individuals aiming to manage their debts successfully.

Statistics Reflecting Debt Repayment Success Rates Among Remote Workers

Data suggest that remote workers may achieve higher success rates in debt repayment compared to their in-office counterparts. The flexibility inherent in remote work enables individuals to manage their time and finances more effectively, facilitating a structured approach to debt repayment.

One contributing factor to this success is the reduced stress associated with remote work. With fewer daily distractions and the elimination of commuting, remote workers can concentrate their efforts on financial planning and debt management. This enhanced focus often results in improved repayment outcomes, as individuals can dedicate time to tracking their progress and adjusting their strategies as necessary.

Furthermore, the ability to generate additional income through freelance or side projects empowers remote workers to allocate extra funds toward debt repayment, further increasing their chances of success. This data underscores the importance of recognizing the unique advantages that remote work can provide when effectively managing and consolidating debt.

Economic Evaluations of the Effects of Remote Work

Economic analyses offer valuable insights into how remote work influences debt consolidation in the UK. As the remote work model becomes increasingly established, understanding its broader implications on the economy and personal finance is essential.

One significant observation is the correlation between remote work and heightened consumer confidence. As individuals adapt to remote roles, they often experience a sense of financial stability that encourages responsible spending and saving behaviors. This newfound confidence can lead to improved debt repayment rates and a greater willingness to explore consolidation options.

Additionally, the evolving economic landscape is shaped by the growing adoption of remote work practices by more companies. This trend may prompt lenders to adjust their criteria for assessing creditworthiness, potentially making it easier for remote workers to access debt consolidation loans. Understanding these shifting dynamics can empower individuals to navigate their financial futures more effectively, ultimately enhancing their ability to manage debt.

Challenges Faced by Remote Workers in Debt Consolidation

The Influence of Job Insecurity on Debt Management

Job insecurity is a significant concern for remote workers, greatly impacting their debt consolidation efforts. The nature of remote work often involves contract or freelance positions, leading to fluctuations in income stability. This unpredictability can create apprehension for both remote workers and lenders regarding the feasibility of debt consolidation loans.

Lenders may be reluctant to approve consolidation applications from remote workers due to worries about job security and income reliability. This challenge can complicate individuals’ efforts to effectively manage their debts, as they may lack access to essential financial products that could facilitate consolidation.

To overcome this obstacle, remote workers should concentrate on establishing a strong financial foundation that demonstrates their creditworthiness. This might involve maintaining a consistent payment history, responsibly managing existing debts, and seeking opportunities for additional income to enhance financial stability.

The Effects of Isolation on Financial Decision-Making

Isolation resulting from remote work can significantly impact financial decision-making and debt consolidation efforts. The absence of in-person interactions may lead to feelings of disconnection, adversely affecting an individual’s ability to make sound financial choices.

When working remotely, individuals may be less inclined to seek advice from financial professionals or engage in discussions with peers about their financial situations. This isolation can result in poor decision-making, such as falling into the trap of high-interest debt or neglecting to consolidate existing debts.

To combat these challenges, remote workers should actively seek support networks, whether through online communities or local groups, to share experiences and advice. Engaging with others facing similar challenges can foster better decision-making and enhance one’s ability to manage debt effectively.

Barriers to Accessing Financial Advice for Debt Consolidation

Accessing reliable financial advice for debt consolidation can prove challenging for remote workers in the UK. While the digital age has made it easier to find information online, many individuals may struggle to identify credible sources or feel overwhelmed by the volume of available content. This can impede effective planning for debt consolidation.

Remote workers should prioritize locating trustworthy financial advisors who understand the unique challenges posed by remote work. Engaging with professionals who specialize in debt management can provide tailored strategies and insights that enhance the effectiveness of consolidation efforts.

Additionally, leveraging online resources such as webinars, podcasts, and articles can supplement formal financial advice. By taking a proactive approach to seek guidance, remote workers can better navigate the complexities of debt consolidation and develop strategies that align with their financial goals.

Enhancing Debt Consolidation Efforts for Remote Workers

Implementing Effective Budgeting Techniques

Implementing effective budgeting is crucial for remote workers aiming to strengthen their debt consolidation efforts. By adopting tailored budgeting techniques, individuals can gain greater control over their finances, ensuring that debt repayment remains a key priority.

One effective method is the zero-based budgeting approach, in which every pound of income is allocated to specific expenses, savings, or debt repayment. This strategy encourages remote workers to scrutinize their spending habits and make informed decisions about fund allocation. Additionally, utilizing budgeting apps can assist in tracking expenses and identifying potential areas for savings.

Another valuable strategy is the 50/30/20 rule, which allocates 50% of income to needs, 30% to wants, and 20% to savings and debt repayment. This method promotes a balanced approach, allowing remote workers to enjoy their income while ensuring they prioritize their long-term financial objectives.

By adopting these budgeting techniques, remote workers can establish a more robust financial strategy that enhances their capability to consolidate debt effectively.

Leveraging Technology for Improved Debt Management

Technology plays a vital role in supporting remote workers with effective debt consolidation. The availability of various financial management tools and applications can streamline the process of tracking expenses, making payments, and monitoring debt levels.

For instance, budgeting apps can help remote workers create and maintain budgets, providing real-time insights into their spending habits. Many of these applications also offer features that allow users to set reminders for upcoming payments, ensuring individuals stay on track with their debt repayment schedules.

Additionally, online platforms for debt consolidation can simplify the process of comparing loan options, enabling remote workers to identify the most advantageous terms available to them. By harnessing technology, individuals can enhance their financial literacy and make informed decisions regarding their debt management strategies.

Ultimately, embracing technological solutions can lead to more effective debt consolidation approaches for remote workers, empowering them to navigate their financial obligations with confidence.

Recognizing When to Seek Professional Guidance

Understanding when to seek professional assistance for debt consolidation is vital for remote workers facing substantial financial challenges. While some individuals may feel capable of managing their debts independently, others may benefit from the insights and guidance of financial professionals.

If remote workers find themselves overwhelmed by their debt levels or struggling to devise an effective consolidation plan, consulting a financial advisor can provide invaluable support. Professionals can assess individual financial situations, offer tailored strategies, and assist in navigating the complexities of debt management.

Moreover, engaging with credit counseling services can provide additional resources and advice for remote workers seeking to improve their debt consolidation efforts. These organizations often possess extensive knowledge and can assist in negotiating with creditors or consolidating existing debts.

By recognizing when to seek professional help, remote workers can significantly enhance their ability to manage debt effectively and take proactive steps toward achieving financial stability.

Negotiating with Creditors for More Favorable Terms

Negotiating with creditors can be a powerful strategy for remote workers looking to strengthen their debt consolidation efforts. By approaching creditors with a clear understanding of their financial situation, individuals may successfully negotiate better terms, lower interest rates, or modified repayment plans.

Remote workers should prepare for negotiations by gathering relevant financial documents, including income statements, expenses, and current debt levels. This information can be utilized to demonstrate their capacity to repay debts while seeking more favorable conditions.

Furthermore, understanding the creditor’s perspective can assist remote workers in tailoring their negotiation approach. By communicating openly and honestly about their financial circumstances, individuals can foster a cooperative relationship with creditors, increasing the likelihood of securing advantageous terms.

Effective negotiation can lead to improved debt consolidation outcomes, enabling remote workers to manage their financial obligations more efficiently.

Creating Additional Income Streams for Enhanced Financial Security

Exploring additional income sources is a strategic approach for remote workers to bolster their debt consolidation efforts. With the flexibility inherent in remote work, individuals can leverage their skills to pursue side gigs, freelance opportunities, or passive income projects.

For instance, remote workers can seek freelance roles that align with their existing skills, such as writing, graphic design, or consulting. By tapping into these opportunities, they can generate extra income that can be directed towards debt repayment and consolidation.

Additionally, investing in passive income streams, such as rental properties or dividend stocks, can provide ongoing financial support. This extra income can supplement regular earnings, enabling remote workers to allocate more funds to their debt management initiatives.

By diversifying income sources, remote workers can create a more resilient financial strategy that effectively supports their debt consolidation goals.

Future Trends in Remote Work and Their Influence on Debt Consolidation

Forecasts for the Continued Growth of Remote Work

The expansion of remote work is expected to continue shaping the financial landscape, including trends in debt consolidation. As more companies adopt flexible work arrangements, remote workers are likely to become a significant demographic within the workforce, prompting shifts in the design and delivery of financial services.

One prediction is that lenders will increasingly tailor their offerings to meet the unique needs of remote workers. This could lead to more accessible debt consolidation loans with flexible terms that account for the variable income patterns commonly associated with remote roles.

Moreover, the ongoing evolution of remote work is anticipated to promote greater financial literacy among individuals, as more resources become available to assist in managing the complexities of personal finance. As remote workers seek effective solutions for their financial challenges, debt consolidation strategies will adapt to align with their changing circumstances.

Ultimately, the sustained growth of remote work is poised to foster a more supportive financial environment for individuals aiming to effectively manage and consolidate their debts.

Technological Innovations Reshaping Debt Solutions

Technological advancements are set to introduce new solutions for debt consolidation among remote workers. As financial technology continues to progress, innovative tools and platforms are emerging to assist individuals in managing their debts more effectively.

For example, the rise of artificial intelligence and machine learning in finance is enabling lenders to offer more personalized loan options based on individual financial profiles. This development could result in tailored debt consolidation solutions that consider the unique circumstances of remote workers.

Furthermore, advancements in digital payment systems are simplifying the debt repayment process. Many individuals can now automate payments, track their debt levels, and receive real-time updates on their financial health, empowering them to stay on top of their obligations more effectively.

As technology continues to revolutionize the financial landscape, remote workers can anticipate enhanced tools and resources that support their debt consolidation efforts, ultimately improving their financial well-being.

Potential Policy Developments and Financial Support for Remote Workers

Future policy changes may significantly impact the financial support available to remote workers in their debt consolidation pursuits. As remote work becomes more entrenched in the economy, policymakers may recognize the need for tailored financial solutions to support this growing demographic.

Possible changes could include introducing incentives for lenders to offer more favorable conditions for remote workers seeking debt consolidation loans. Additionally, government-backed initiatives aimed at promoting financial literacy and responsible borrowing may emerge in response to the unique challenges faced by remote employees.

As these policies evolve, remote workers may discover more resources and options to navigate their financial obligations effectively. By staying informed about policy changes, individuals can proactively adapt their strategies for debt consolidation and overall financial management.

Frequently Asked Questions

In what ways does remote work impact income levels?

Remote work can lead to varying income levels, especially for freelancers or contract workers. While some may benefit from reduced commuting costs, others might face uncertainties related to client availability.

Are debt consolidation services easily accessible for remote workers?

Accessibility varies; while digital platforms create new opportunities, geographical location and familiarity with online services can impact ease of access for remote workers.

What budgeting techniques are effective for remote workers?

Techniques such as zero-based budgeting and the 50/30/20 rule can assist remote workers in efficiently allocating funds for expenses, savings, and debt repayment.

How can technology support debt management?

Technology offers various tools for tracking expenses, automating payments, and comparing loan options, simplifying the debt management process for remote workers.

When should remote workers seek professional financial assistance?

If remote workers feel overwhelmed by debt or lack a clear repayment strategy, consulting a financial advisor can provide tailored insights and guidance.

What strategies can remote workers use to negotiate with creditors?

Preparing relevant financial documents and communicating openly about their financial situations can enhance remote workers’ effectiveness in negotiating better terms with creditors.

Are there advantages to diversifying income streams?

Yes, varied income sources can provide additional funds for debt repayment, making it simpler to manage and consolidate debts for remote workers.

How does job insecurity affect debt consolidation?

Job insecurity can create apprehension for lenders, complicating remote workers’ ability to secure debt consolidation loans due to perceived income instability.

What impact does isolation have on financial decision-making?

Isolation from remote work can lead to poor financial decisions, as individuals may lack access to advice and support from peers or professionals.

How can remote workers optimally leverage financial resources?

Remote workers should engage with reliable financial advisors, utilize online resources, and participate in community networks to enhance their understanding of debt consolidation and personal finance management.

Connect with us on Facebook!

This Article Was First Found On: https://www.debtconsolidationloans.co.uk

The Article Remote Work and Its Impact on Debt Consolidation in the UK Was Found On https://limitsofstrategy.com