Enhancing Physical Health and Vitality in Your Retirement Journey

Retirement opens a door to a myriad of opportunities while simultaneously presenting unique health challenges that require attention. Prioritizing men’s health during retirement calls for a proactive strategy aimed at nurturing physical wellness. This proactive approach is essential for ensuring that individuals can enjoy vibrant and fulfilling lives after decades of hard work. Key practices include engaging in regular physical activity, benefiting from NHS health checks, maintaining a balanced and nutritious diet, and scheduling routine health screenings. Moreover, incorporating activities that bolster mental well-being can greatly enhance overall health during these crucial years, creating a balanced synergy between physical vitality and mental clarity.

Embracing Regular Exercise to Maximize Health Benefits

Retirement presents an ideal opportunity to adopt a more active lifestyle, a shift that can significantly enhance men’s health during retirement. Engaging in enjoyable activities such as walking, swimming, and cycling not only brings pleasure but also plays a crucial role in maintaining physical fitness. Consistent participation in these exercises boosts cardiovascular health, aids in weight management, and increases energy levels, thus making daily tasks easier and more enjoyable. By integrating these activities into a regular routine, retirees can transform their quality of life, promoting longevity and vibrancy as they explore the joys of their later years.

Walking is one of the most accessible forms of exercise, requiring minimal equipment and preparation. The picturesque trails scattered across the UK, including the breathtaking South West Coast Path and the enchanting paths of the Lake District, offer retirees the perfect setting to connect with nature while increasing their step counts. These walks serve dual purposes: they can be personal retreats for quiet reflection or enjoyable social outings with friends, fostering connections and enhancing both physical activity and social interaction. Such engagements are essential for holistic well-being, nurturing both body and mind.

Swimming stands out as an excellent low-impact exercise option, particularly beneficial for individuals facing joint issues. Numerous leisure centres across the UK provide specially designed swimming classes for seniors, ensuring a safe and enjoyable fitness experience. The buoyancy of water alleviates strain on joints while delivering a robust cardiovascular workout, making swimming an exceptional choice for maintaining stamina and overall fitness levels. This activity contributes positively to a healthier, more enjoyable retirement, allowing retirees to stay active and engaged.

Cycling is another fantastic way to promote cardiovascular health while being gentle on the joints. Whether enjoying leisurely rides through local parks or embarking on adventurous cycling excursions through the stunning Cotswolds, this activity improves muscle strength and enhances joint flexibility. Regular engagement in this form of exercise can facilitate a healthier, more dynamic retirement, empowering individuals to relish their newfound freedom and mobility while soaking in the breathtaking scenery along the way.

Maximizing Health Through Free NHS Health Checks

Taking full advantage of the complimentary NHS health checks available for individuals aged 40 to 74 is a vital step in proactively managing health during retirement. These health assessments are crucial for identifying potential health issues at an early stage, enabling timely interventions that can significantly impact long-term well-being. The NHS conducts these health checks every five years, monitoring essential risk factors such as blood pressure, cholesterol levels, and diabetes, which are all critical for retirees aiming to maintain optimal health.

Although concerns about healthcare expenses can weigh heavily on retirees, these essential health checks are provided free of charge and can yield invaluable insights into an individual’s health status. While scheduling an appointment with a GP for an NHS health check may seem daunting, it is a crucial step toward sustaining a healthy lifestyle. The results of these assessments offer personalized guidance regarding lifestyle modifications and necessary medical interventions, empowering retirees to take charge of their health proactively and effectively.

Furthermore, these health checks present an excellent opportunity to discuss any health concerns with knowledgeable healthcare professionals. Health encompasses not just physical conditions but also mental well-being, which can be addressed during these visits, ensuring retirees receive comprehensive care. By engaging in regular health checks, individuals can build a solid foundation for a healthier future, mitigating risks associated with aging, and equipping them to navigate their retirement years with confidence and assurance.

Prioritizing Nutrition and Diet for a Longer Life

A well-balanced diet is fundamental for maintaining vitality throughout retirement. Adopting a diet abundant in fruits, vegetables, and whole grains can significantly enhance heart health and overall well-being. Retirees should focus on consuming nutrient-dense foods that provide essential vitamins and minerals necessary to combat age-related health issues, thereby promoting a longer, healthier life.

Incorporating a colorful variety of foods on one’s plate not only enhances the visual appeal of meals but also ensures a comprehensive spectrum of nutrients. Local markets across the UK are treasure troves of fresh produce that can inspire retirees to experiment with new recipes, fostering creativity in the kitchen. Whole grains, including oats and brown rice, should form the foundation of meals, supplying vital fiber that promotes digestive health and overall wellness, thus supporting active lifestyles.

Heart health is particularly critical for men in retirement. Consuming foods rich in omega-3 fatty acids, such as fish, along with those high in antioxidants, like berries, can significantly reduce the risk of heart disease. Participating in community cooking classes can equip retirees with the knowledge and motivation to prepare nutritious meals, transforming the act of eating into a rewarding activity rather than a mundane chore, thereby greatly enhancing their overall quality of life and health.

Staying adequately hydrated is another essential aspect, especially as the body’s thirst response tends to diminish with age. Water should be the primary beverage of choice, while herbal teas and infused waters can offer delightful alternatives. By prioritizing healthy eating habits, retirees can nourish their bodies for an active lifestyle, reaping the numerous benefits that come with good nutrition, ultimately enhancing both physical and mental well-being.

The Importance of Regular Health Screenings for Early Detection

Scheduling regular health screenings is crucial for identifying and addressing potential health issues early, which ensures a healthier retirement experience. These screenings may encompass blood tests, cancer screenings, and check-ups for chronic conditions, providing vital insights into one’s health status. The earlier health issues are detected, the more effectively they can be managed, leading to improved health outcomes and an enhanced quality of life.

Most GP practices in the UK recommend routine screenings tailored to age and individual risk factors. For instance, men over 50 should consider prostate cancer screenings, while a simple blood test can monitor cholesterol and glucose levels. Retirees should feel empowered to engage in candid discussions with their doctors about which screenings are appropriate for them, ensuring they take control of their health proactively.

Awareness and education regarding potential health risks can also empower men during their retirement years. Understanding family medical history is crucial, as it can inform screening decisions; for example, if heart disease is prevalent in the family, regular cardiovascular check-ups become imperative. Proactively managing health through screenings not only aids in personal wellness but can also profoundly enhance the quality of life during retirement.

Retirees should adopt a proactive mindset regarding health by scheduling these screenings consistently. This approach not only assists in managing existing health conditions but also fosters a sense of control over one’s health and well-being. Empowerment through knowledge is a vital component in successfully navigating the health landscape of retirement, enabling individuals to fully embrace their golden years.

Integrating Mental Health with Physical Activity for Holistic Wellness

In retirement, maintaining mental health is just as imperative as physical well-being. Integrating physical activities that also enhance mental health can significantly contribute to overall wellness. Practices such as yoga and tai chi are not only gentle on the body but also promote mindfulness and stress reduction, creating a comprehensive approach to health.

Yoga, for instance, offers numerous benefits, including improved flexibility and strength, which are particularly important for older adults. Many local community centres provide classes, while online resources allow retirees to practice comfortably at home. The meditative aspects of yoga help alleviate anxiety and foster inner peace, contributing to emotional stability and resilience.

Tai chi, often referred to as “meditation in motion,” is another excellent option. This gentle martial art enhances balance and coordination, helping to prevent falls—one of the most significant risks faced by older adults. Numerous parks and community groups offer free tai chi sessions, making it an accessible and beneficial option for many retirees, thus promoting both physical and mental health.

Engaging in these activities supports physical fitness and offers valuable opportunities for social interaction. Group classes foster connections among participants, combating feelings of loneliness and isolation that can sometimes accompany retirement. By intertwining physical activity with mental health practices, retirees can cultivate a well-rounded approach to their overall health, significantly enhancing their quality of life during this transformative period.

Cultivating Mental Well-Being for a Fulfilling Retirement

The mental health of retirees is paramount for enjoying a fulfilling and satisfying retirement. As individuals transition from the structured environment of work to the newfound freedom that retirement brings, maintaining strong social connections, participating in cognitive activities, and accessing mental health services can profoundly enhance their quality of life. Addressing mental well-being is critical for embracing this new chapter with enthusiasm and joy, ensuring a rich and meaningful retirement experience.

Fostering Strong Social Connections to Combat Loneliness

Strong social connections are essential for preserving mental health during retirement. Engaging with community groups, clubs, or family gatherings can help retirees feel connected and supported. Loneliness and isolation can pose significant challenges for older adults, potentially leading to mental health issues such as depression and anxiety, which can negatively impact overall well-being.

Participating in local clubs or groups can provide retirees with a sense of belonging and community. From walking groups and gardening clubs to book clubs and volunteer organizations, there are numerous options available. Many retirees discover renewed purpose through volunteering, offering their time and skills to local charities or schools, which not only enhances social interactions but also fosters a sense of achievement and fulfillment.

Family gatherings play a significant role in maintaining close relationships. Regular visits from children and grandchildren can uplift emotional well-being, fostering feelings of love and importance. Organizing family events or engaging in shared activities can further strengthen these bonds, ensuring that retirees remain engaged and connected with their loved ones, enriching their retirement experience immeasurably.

Furthermore, modern technology provides various ways to stay connected with friends and family, even from afar. Video calls, social media, and messaging apps can help keep relationships vibrant and thriving. Thus, nurturing and maintaining these connections is pivotal in supporting mental health during retirement, creating a fulfilling and rich life.

Engaging in Cognitive Activities to Sharpen the Mind

Participating in cognitive activities is vital for keeping the mind sharp and decreasing the risk of cognitive decline during retirement. Activities such as puzzles, reading, and learning new skills provide not only mental stimulation but also foster a sense of accomplishment and satisfaction, greatly enhancing overall mental health.

Regularly challenging the brain with puzzles, crosswords, and sudoku can bolster memory and cognitive abilities. Many community centres in the UK offer classes in various subjects, ranging from languages to art, providing retirees with opportunities to learn and engage socially. This pursuit of lifelong learning not only sharpens the mind but also instills a sense of purpose, contributing to emotional well-being and satisfaction.

Reading is another excellent way to stimulate the brain. Joining a book club can enhance this experience by adding a social component, encouraging discussions and exchanges of ideas that keep the mind engaged and sharp. Libraries often host reading groups or events, facilitating connections with others who share similar interests, thus enriching the social aspect of reading.

Adapting to new technology also offers cognitive benefits. Learning to use smartphones, tablets, or computers may seem daunting but can be incredibly rewarding. Many community centres provide classes specifically designed for seniors, teaching them how to navigate the digital world effectively. This engagement not only enhances mental agility but also ensures retirees remain connected with family and friends, fostering a sense of community and belonging.

By actively engaging the mind, retirees can cultivate a vibrant mental landscape that helps stave off cognitive decline and enriches their overall quality of life, ensuring that retirement is a time filled with joy and discovery.

Utilizing Mental Health Services for Comprehensive Support

Accessing mental health services is crucial for addressing psychological challenges that may arise during retirement. The NHS offers a range of mental health support and counselling services tailored to the unique needs of older adults. Seeking help is a sign of strength, not weakness, and can lead to transformative experiences that enhance overall well-being.

Many retirees may feel hesitant to discuss their mental health concerns, fearing stigma or judgment. However, the NHS provides confidential services that allow individuals to speak openly about their feelings and challenges. Whether it’s anxiety, depression, or feelings of loneliness, trained professionals can offer guidance and support tailored to individual needs, making it easier for retirees to navigate their emotional landscape.

Counselling services, including Cognitive Behavioural Therapy (CBT), are available through local NHS practices. These therapies can equip retirees with effective strategies to manage stress and improve mental well-being. Engaging in therapy not only provides practical coping strategies but also offers a safe space to explore emotions and concerns, fostering emotional resilience during retirement.

Support groups, often facilitated by local organizations or healthcare providers, can also play an essential role in mental health. These groups foster a sense of community, allowing retirees to share experiences and connect with others facing similar challenges. By accessing these valuable resources, retirees can take significant steps towards enhancing their mental health, leading to a more satisfying and fulfilling retirement experience.

Strategic Financial Planning for a Secure and Comfortable Retirement

Financial stability is a cornerstone of a successful retirement, enabling individuals to enjoy their golden years without undue stress. Understanding pension management, developing comprehensive budgeting strategies, seeking professional financial advice, exploring retirement investment options, and engaging in tax planning are integral components of financial planning that can secure a comfortable lifestyle during retirement.

Mastering Pension Management to Ensure Financial Security

Understanding and managing state and private pensions is paramount for ensuring financial stability throughout retirement years. The UK’s state pension provides a foundational income; however, many retirees find it necessary to supplement this with private pensions or personal savings to maintain their desired lifestyle. This understanding is crucial for securing a financially sound future.

To maximize state pension benefits, it’s vital to verify eligibility and comprehend how contributions affect the amount received. The state pension age varies, so retirees should stay informed about any changes to ensure they receive their entitlements at the appropriate time. Additionally, monitoring National Insurance contributions can help retirees clarify their state pension rights and benefits.

Private pensions, whether defined benefit or defined contribution schemes, require careful attention to ensure they align with retirement goals. Understanding the specifics of these pensions—such as when to access funds and the implications of drawing money early—can significantly impact financial security. Regularly reviewing pension statements to ensure everything is on track and making necessary adjustments is advisable, allowing retirees to manage their finances effectively.

Retirees should also contemplate consolidating multiple pensions into one manageable scheme, simplifying financial management. Seeking advice from a financial advisor can be invaluable in navigating the complexities of pension management, ensuring that retirees make informed decisions that enhance their financial well-being throughout retirement.

Implementing Effective Budgeting Strategies for Financial Management

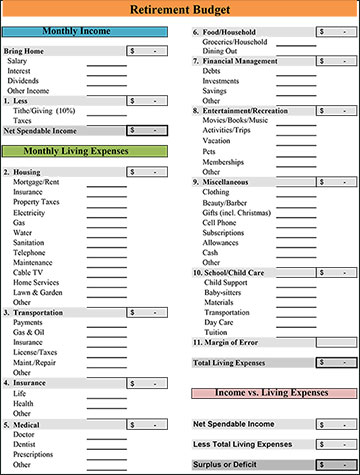

Implementing robust budgeting strategies is vital for efficiently managing living expenses during retirement and maintaining a comfortable lifestyle. Creating a detailed budget enables retirees to track income and expenses, identify areas for potential savings, and ensure that spending aligns with their financial goals, fostering a secure retirement experience.

Begin by listing all sources of income, including state pensions, private pensions, investments, and any part-time work. This comprehensive overview serves as a foundation for budgeting. Next, outline monthly expenses, categorising them into essentials (e.g., housing, utilities, food) and discretionary spending (e.g., entertainment, travel) to gain a clearer understanding of financial dynamics.

Retirees should regularly review their budgets, adjusting as needed to reflect changing financial situations. For instance, unexpected medical expenses may necessitate reallocating funds from leisure activities. Maintaining flexibility within the budget can alleviate stress and ensure financial stability, allowing retirees to fully enjoy their retirement without financial strain.

Furthermore, retirees should consider establishing an emergency fund to cover unforeseen costs. This fund can provide peace of mind, ensuring that retirees do not have to dip into long-term savings for unexpected circumstances. By adopting strong budgeting strategies, retirees can enjoy their golden years with confidence and security, knowing their finances are well-managed.

Seeking Expert Financial Advice for Better Financial Outcomes

Seeking guidance from financial advisors can be a game-changer for retirees aiming to maximize their savings and investments effectively. Financial advisors provide tailored advice based on individual circumstances, assisting retirees in navigating the complexities of managing their finances during retirement.

Advisors can help create a comprehensive financial plan that encompasses pensions, investments, and budgeting. This plan should align with retirement goals, considering factors such as desired lifestyle, travel aspirations, and healthcare needs, thus ensuring that financial strategies are well-informed and relevant.

Moreover, understanding investment options is crucial for effectively growing savings. Financial advisors can elucidate various investment vehicles, including stocks, bonds, and real estate, recommending strategies that suit risk tolerance and long-term objectives. This guidance is invaluable for retirees who may be unfamiliar with investing or seeking to optimize their portfolios for maximum returns.

Regular meetings with a financial advisor can ensure retirees stay on track with their financial goals and adjust strategies as needed. By collaborating with a professional, retirees can enjoy peace of mind, knowing they have a solid financial foundation supporting their retirement and can focus on enjoying their newfound freedom.

Diverse Retirement Investment Opportunities for Financial Growth

Exploring a variety of investment vehicles suitable for retirement is essential for effectively growing savings. Retirees have numerous options to consider, including annuities, stocks, bonds, and property investments, each with its unique advantages and risks, allowing for tailored investment strategies.

Annuities can provide a steady income stream during retirement, which can be particularly beneficial for those seeking stability in financial planning. However, it’s crucial to understand the terms and conditions, as certain annuities can be complex and may incur fees. Engaging with a financial advisor can help clarify these options, ensuring retirees select products aligned with their financial goals and needs.

Investing in stocks offers growth potential, albeit with higher risks. A diversified portfolio can help mitigate these risks while providing opportunities for capital appreciation. Many retirees opt for dividend-paying stocks, which can provide a regular income stream while still allowing for potential growth, thus effectively balancing risk and reward.

Bonds represent another popular choice, offering a relatively stable investment with lower risk compared to stocks. Government bonds, in particular, can be a secure investment for retirees looking for income and capital preservation, providing a sense of financial security.

Lastly, property investments can yield both rental income and potential appreciation in value. However, managing property can introduce its own challenges, and retirees should carefully consider whether they are prepared to take on this level of commitment. Understanding these diverse options empowers retirees to make informed decisions that contribute to financial security throughout their retirement years.

Tax Planning Strategies to Optimize Retirement Income

Understanding tax implications and strategies for optimizing income is crucial for retirees seeking to reduce tax liabilities during their retirement years. As individuals transition into retirement, their income sources may shift, necessitating a review of tax strategies to maximize financial efficiency and preserve wealth.

Pensions, savings, and investments are often subject to different tax treatments. For instance, retirees should be aware of tax-free allowances for pensions and ISAs, which can help them manage their taxable income effectively. Engaging in tax-efficient withdrawals can significantly impact overall finances, ensuring retirees maximize their income while minimizing tax liabilities.

Additionally, retirees should consider structuring their assets to minimize tax. This might involve exploring options such as gifting assets to family members or establishing trusts to effectively manage wealth. Each individual’s situation will differ, and personalized advice from a tax professional can provide insights into potential savings, ensuring that retirees retain more of their hard-earned money.

Regular reviews of tax situations can help retirees stay informed about any changes in legislation or personal circumstances that may impact their tax liabilities. Understanding the tax landscape is essential for preserving wealth and ensuring a comfortable lifestyle throughout retirement, allowing retirees to enjoy their years without financial worry.

Accessing Quality Healthcare Services During Retirement

Accessing healthcare is a fundamental aspect of ensuring a healthy and fulfilling retirement. With the extensive services provided by the NHS alongside private healthcare options, retirees can effectively address their healthcare needs. Managing prescriptions, dental care, and optical services also plays a significant role in maintaining overall health during retirement, ensuring that individuals receive the care they require.

Utilizing NHS Services for Comprehensive Healthcare Access

Utilizing the extensive healthcare services offered by the NHS is crucial for retirees in the UK. The NHS provides a wide array of services, from general practitioner visits to specialist care, ensuring that individuals have access to necessary medical attention throughout their retirement. This access is vital for maintaining good health and addressing any health concerns that may arise.

Regular GP visits are essential for monitoring health issues and addressing any concerns. Retirees should not hesitate to seek advice or treatment, as early intervention can lead to better health outcomes. Many GP practices in the UK now offer online appointment booking and consultations, making healthcare more accessible and convenient for retirees, thus enhancing their access to necessary medical services.

Additionally, the NHS provides a plethora of screening services, allowing retirees to monitor their health proactively. Routine screenings for conditions such as diabetes, heart disease, and certain cancers are vital for catching issues early, leading to more effective treatment options and improved health outcomes, thereby ensuring a healthier retirement.

The NHS also offers specialized services for specific health concerns, including mental health support, physiotherapy, and rehabilitation services. Understanding the breadth of services available empowers retirees to seek help and maintain their overall well-being, significantly enhancing their quality of life during retirement and making healthcare a cornerstone of a healthy lifestyle.

Exploring Private Healthcare Options for Enhanced Medical Care

Exploring private healthcare options can provide retirees with quicker access to treatments and additional services not covered by the NHS. While the NHS offers comprehensive care, waiting times for certain procedures can be lengthy, prompting many retirees to consider private healthcare as a means to expedite their access to essential medical services.

Private health insurance can cover a range of services, including specialist consultations, diagnostic tests, and elective procedures. Retirees should carefully assess their healthcare needs and consider whether investing in private health insurance aligns with their financial planning and healthcare goals, ensuring that they have the necessary support for their health.

Moreover, private healthcare often offers more flexibility in appointment times and locations, which can be especially appealing for those who may struggle with transport or lengthy waiting times. Some private facilities also provide enhanced comfort and amenities, contributing to a more positive healthcare experience, thereby improving overall satisfaction with medical care.

It’s crucial for retirees to research and compare private healthcare options to find the best fit for their needs and budget. Engaging in discussions with healthcare professionals can provide insights into the most suitable routes, ensuring individuals make informed decisions regarding their health and well-being throughout their retirement.

Streamlining Prescription Management for Continuous Access to Medications

Efficiently managing prescriptions through the NHS is vital for ensuring continuous access to necessary medications during retirement. Many retirees may require ongoing medication for chronic conditions, making it essential to understand how to navigate the prescription process effectively, thus ensuring that their health needs are consistently met.

NHS prescription services are available to assist retirees in managing their medications, including the option for repeat prescriptions. Many GP practices allow patients to order repeat prescriptions online or via phone, ensuring easy access to medications without needing to visit the practice in person, thus streamlining healthcare management.

Understanding eligibility for free prescriptions is also crucial for retirees. Many individuals aged 60 and over qualify for free prescriptions, significantly easing the financial burden of managing ongoing medical needs. This awareness is key to maintaining health while managing costs effectively.

Moreover, it’s vital for retirees to maintain clear communication with healthcare providers regarding their medications. Regular reviews of prescriptions can help ensure that individuals remain on the most effective treatment plans, optimizing health outcomes. By taking control of prescription management, retirees can maintain their health and well-being during their retirement years, ensuring a fulfilling lifestyle.

Prioritizing Dental and Vision Health for Overall Well-Being

Accessing dental and optical services through the NHS or private providers is crucial for maintaining oral and eye health during retirement. As individuals age, the risk of dental issues and vision problems increases, making regular check-ups essential for prevention and early detection.

NHS dental services offer a variety of treatments, including check-ups, fillings, and preventative care. Many retirees qualify for reduced fees or free treatments, depending on their financial circumstances. Regular dental visits can help identify issues early, preventing more severe problems down the line, thus ensuring optimal oral health.

Similarly, NHS optical services provide essential eye care, including sight tests and access to glasses or contact lenses. Retirees should schedule regular eye examinations to monitor vision changes and address any concerns promptly. Many high street opticians also offer NHS-funded services, making it easier for retirees to access necessary care, thus supporting eye health and overall well-being.

For those seeking additional options, private dental and optical services offer more flexibility in terms of appointment times and treatment choices. Exploring both NHS and private care can empower retirees to make informed decisions regarding their oral and eye health, ensuring they maintain overall well-being during retirement, thus enhancing their quality of life.

Exploring Leisure Activities and Hobbies for Greater Fulfillment in Retirement

Retirement presents an excellent opportunity to delve into interests and hobbies that may have been set aside during working years. Pursuing new passions, engaging in volunteering opportunities, and exploring the UK can greatly enhance retirees’ quality of life, providing a sense of purpose and enjoyment that enriches the retirement experience.

Discovering New Interests and Hobbies for Self-Fulfillment

Exploring new hobbies or rekindling old interests is a fulfilling way to remain engaged and satisfied during retirement years. Whether it’s painting, gardening, cooking, or learning a musical instrument, pursuing interests can enhance creativity and promote overall well-being, fostering a sense of joy and satisfaction.

Numerous community centres and local organisations offer classes tailored to seniors, making it easy to discover new hobbies that spark joy and creativity. These classes often serve as social gatherings, fostering connections among retirees who share similar interests. For instance, joining a photography club can inspire creativity while exploring scenic locations across the UK, enhancing both artistic skills and social interaction.

Gardening is another popular pursuit that combines physical activity with relaxation. Retirees can cultivate their gardens, growing flowers, vegetables, or herbs, providing both beauty and a sense of achievement. Community gardens also offer opportunities to connect with neighbours while enjoying the therapeutic benefits of gardening, thus promoting emotional well-being and community engagement.

Engaging in hobbies provides a vital outlet for expression and creativity, contributing to emotional health and happiness. By dedicating time to activities that bring joy, retirees can lead more fulfilling lives, making the most of their retirement years and embracing opportunities for growth and enjoyment.

Engaging in Meaningful Volunteering Opportunities

Participating in local volunteering activities is a rewarding way for retirees to stay active, contribute to the community, and maintain social connections. Volunteering not only benefits those in need but also enhances the volunteer’s well-being, creating a sense of purpose and fulfillment that enriches the retirement experience.

Many charities and community organisations across the UK welcome retirees as volunteers, offering a range of opportunities from mentoring to conservation work. Engaging in volunteer work can also provide a platform for retirees to share their skills and experiences, helping to inspire the next generation and contribute positively to society.

Moreover, volunteering fosters social interactions, combating feelings of isolation that can accompany retirement. Building relationships with fellow volunteers and those served can create a support network, enhancing emotional health and well-being, thus enriching the overall retirement experience.

Retirees should explore local volunteering opportunities that align with their interests and values, allowing them to make meaningful contributions to their communities. By integrating volunteering into their retirement plans, individuals can enrich their lives while positively impacting others, creating a fulfilling and joyful retirement journey.

Traveling and Discovering the Beauty of the UK for Enriching Experiences

Taking advantage of retirement to travel within the UK presents a unique opportunity to discover new places and cultures. The UK boasts an abundance of destinations, from the stunning landscapes of Scotland to the historical sites of England and the picturesque coasts of Wales, offering retirees a chance to experience the beauty and diversity of their home country.

Retirees should consider planning trips to explore national parks, such as the breathtaking Peak District or Snowdonia, which provide stunning views and opportunities for outdoor activities. Coastal towns like St Ives and Whitby offer charming retreats, allowing for relaxation and exploration of local culture, thus enhancing overall enjoyment and satisfaction during retirement.

Traveling also presents the chance to connect with family and friends. Organizing trips to visit loved ones or inviting them to join on adventures can create lasting memories and strengthen bonds, fostering deeper relationships and shared experiences.

Moreover, many travel companies provide senior discounts and tailored package tours, making travel more accessible and affordable. By embracing travel opportunities during retirement, individuals can enrich their lives, broaden their horizons, and create cherished memories that last a lifetime, enhancing their overall quality of life.

Making Informed Decisions About Housing and Living Arrangements

Making informed decisions about housing and living arrangements is crucial for retirees seeking comfort and independence. Options such as downsizing, retirement communities, and home modifications can all contribute to a more manageable lifestyle during retirement. Each choice presents its unique advantages, depending on personal circumstances and preferences, ensuring that retirees can fully enjoy their golden years.

Evaluating Downsizing Options for Simplified Living

Considering downsizing to a smaller, more manageable home can be a practical decision for retirees looking to reduce living expenses and maintenance efforts. A smaller home often requires less upkeep, freeing up valuable time for hobbies and social activities that enhance quality of life.

Many retirees find that moving to a bungalow or a flat can significantly improve their quality of life, particularly if mobility challenges arise. Lower maintenance means less stress, allowing individuals to focus on enjoying their retirement. Additionally, selling a larger home can generate extra funds that can be allocated towards travel, health, or leisure activities, thus improving overall financial flexibility.

Retirement-friendly neighbourhoods often feature amenities and services tailored to older adults, enhancing convenience and accessibility. Proximity to healthcare facilities, shopping centres, and community activities can significantly ease daily living, making it easier for retirees to engage in their desired lifestyle.

Ultimately, downsizing can lead to a more fulfilling and manageable retirement experience, allowing individuals to embrace the opportunities that come with this new phase of life while enjoying the benefits of a simplified living situation.

Exploring Retirement Communities for Enriched Living Experiences

Exploring retirement villages and communities designed to support independent living and social engagement can provide a rich and fulfilling experience for retirees. These communities often offer a variety of amenities, including recreational activities, dining options, and healthcare services, all tailored to the needs of older adults.

Living in a retirement community can foster connections with like-minded individuals, reducing feelings of isolation. Many communities host events, classes, and outings that encourage socialization and engagement, creating a vibrant atmosphere that significantly enhances emotional well-being and makes retirement a more enjoyable experience.

Furthermore, retirement communities often provide varying levels of care, allowing retirees to transition seamlessly should their health needs change. Whether it’s independent living, assisted living, or memory care, these options ensure that individuals receive the appropriate support as needed, thus enhancing their quality of life and peace of mind.

Exploring retirement communities can offer retirees a sense of belonging and security, enabling them to fully embrace this new chapter of life while enjoying a supportive and engaging environment that enhances their overall retirement experience.

Implementing Home Modifications for Enhanced Safety and Comfort

Making essential home modifications is vital for ensuring safety and comfort as health needs change during retirement. Simple adjustments can significantly improve accessibility, allowing retirees to maintain independence and minimize the risk of accidents, thereby enhancing their quality of life.

Installing grab bars in bathrooms, widening doorways, and ensuring that living spaces are free of trip hazards can create a safer environment for older adults. Additionally, considering a walk-in shower or a stairlift can make daily activities more manageable, enhancing convenience and comfort in the home, thus supporting overall independence.

Engaging with occupational therapists can provide valuable insights into specific modifications that may be beneficial. These professionals can assess individual needs and recommend alterations that promote safety and independence, ensuring that retirees can navigate their homes with ease and confidence.

By proactively addressing potential challenges through home modifications, retirees can create a living space that supports their lifestyle and well-being, allowing them to enjoy a fulfilling retirement in the comfort of their own homes while fostering a sense of security and independence.

Legal and Estate Planning for Peace of Mind in Retirement

Proper legal and estate planning is essential for ensuring that retirees’ wishes are respected and their assets are managed effectively. Creating or updating a will, establishing a power of attorney, and considering inheritance issues are critical components of this process that can provide peace of mind and ensure that one’s legacy is preserved.

Drafting a Clear Will for Effective Asset Distribution

Creating or updating a will is one of the most important aspects of estate planning for retirees. A clear and well-drafted will ensures that assets are distributed according to personal wishes after one’s passing, providing clarity and reducing potential conflicts among heirs, thus promoting family harmony.

Retirees should consider regular reviews of their wills to reflect any changes in circumstances, such as marriage, divorce, or the birth of grandchildren. Collaborating with a solicitor to draft or update a will can ensure that all legal requirements are met, providing peace of mind and ensuring that one’s intentions are clearly articulated.

Additionally, retirees should include clauses that address specific wishes, such as guardianship for minors or charitable donations. This level of planning ensures that an individual’s legacy aligns with their values and priorities, allowing retirees to leave a meaningful impact on their loved ones and community.

Developing a comprehensive will not only provides clarity for loved ones but also alleviates the emotional burden during a difficult time. By prioritizing this aspect of estate planning, retirees can leave behind a well-organized estate, reflecting their intentions and caring for their family’s future, thus ensuring that their legacy is honorably preserved.

Establishing a Power of Attorney for Critical Health and Financial Decisions

Setting up a lasting power of attorney is a crucial step for retirees to manage finances and health decisions in the event of diminished mental capacity. This legal arrangement ensures that trusted individuals can make decisions on behalf of the retiree, safeguarding their interests during challenging times and ensuring that their wishes are respected.

Choosing a power of attorney involves selecting someone trustworthy and capable, as this individual will hold significant responsibilities. It’s advisable to discuss these wishes openly with the chosen person to ensure they are willing and able to fulfill this important role in the individual’s life.

A lasting power of attorney covers both financial and health decisions, providing a comprehensive framework for managing affairs if needed. Establishing this legal structure can prevent potential disputes among family members and ensure that decisions align with the retiree’s wishes, thus promoting peace of mind and stability.

By prioritizing this aspect of legal planning, retirees can secure their peace of mind and protect their rights, safeguarding their well-being throughout retirement while ensuring that their wishes are respected and upheld.

Addressing Inheritance Concerns for Future Generations

Inheriting wealth can significantly impact the financial landscape of retirees and their families. It’s crucial for individuals to consider how inheritance is managed and communicated, as this can influence family dynamics and financial planning, ensuring a smooth transition of assets.

Retirees should establish clear guidelines for their heirs regarding how their assets will be distributed. This can involve open discussions with family members about expectations and wishes, reducing potential conflicts and misunderstandings in the future, thus fostering a harmonious family environment.

Additionally, understanding the tax implications of inheritance can guide planning efforts. Engaging with financial advisors can help retirees navigate these complexities, ensuring that their legacy is preserved while benefiting future generations and minimizing tax liabilities effectively.

By addressing inheritance issues openly and thoughtfully, retirees can foster a sense of unity among family members, creating a harmonious transition of wealth and ensuring that their wishes are respected, thus enhancing familial bonds and ensuring a stable financial future for their heirs.

Frequently Asked Questions About Retirement Planning and Well-Being

What are the essential components of men’s health during retirement?

The essential components include physical health, mental well-being, financial planning, access to healthcare, leisure activities, housing arrangements, and legal considerations. Each aspect contributes to a fulfilling retirement experience, ensuring that retirees can thrive during this transformative life stage.

How can retirees maintain their physical health effectively?

Engaging in regular exercise, utilizing NHS health checks, consuming a balanced diet, scheduling health screenings, and incorporating activities that benefit mental health are vital for maintaining physical health. Collectively, these practices support overall well-being in retirement.

What mental health resources are available for retirees to utilize?

Retirees can access NHS mental health support, counselling services, and local community groups designed to foster social connections and provide emotional support. These resources are crucial for maintaining mental well-being during retirement.

How should retirees approach financial planning for retirement?

Understanding pension management, implementing budgeting strategies, seeking professional financial advice, exploring investment options, and engaging in tax planning are essential for achieving financial stability during retirement. These strategies ensure retirees can enjoy their years without financial stress.

What healthcare services are accessible for retirees in the UK?

Retirees can access comprehensive NHS services, including GP visits, specialist care, and free health checks. Private healthcare options are also available for quicker access to treatments and additional services, ensuring individuals receive the care they need.

What hobbies should retirees consider pursuing to enhance their lives?

Retirees can explore hobbies such as gardening, painting, cooking, or volunteering. Engaging in these activities enhances creativity, promotes well-being, and fosters social connections, enriching the retirement experience.

How can retirees effectively manage their housing arrangements?

Considering downsizing, exploring retirement communities, and making necessary home modifications can improve living arrangements and ensure safety and comfort, enabling retirees to lead fulfilling lives in their chosen environments.

What legal planning is essential for retirees to consider?

Creating or updating a will, establishing a lasting power of attorney, and discussing inheritance plans are crucial aspects of legal and estate planning for retirees. These steps ensure that individuals’ wishes are respected and their assets are managed effectively.

How can retirees maintain strong social connections?

Engaging in community groups, participating in clubs, and maintaining family relationships are vital for supporting mental health and ensuring a fulfilling retirement experience, promoting a sense of belonging and connection.

What are the benefits of volunteering during retirement?

Volunteering offers opportunities to stay active, contribute to the community, build social connections, and enhance emotional well-being, creating a sense of purpose and fulfillment during retirement.

The Article Men’s Health and Retirement: A Vital Guide Was First Published On https://acupuncture-frome.co.uk

The Article Men’s Health: Essential Insights for Retirement Planning Was Found On https://limitsofstrategy.com