Explore the Thriving Mid-level Property Market in Witbank

Detailed Examination of Current Market Trends

The mid-level property market in Witbank has demonstrated remarkable resilience and adaptability in response to the evolving demands of homebuyers in recent years. As families and professionals increasingly seek out affordable housing options, the competitive environment within this market segment has intensified significantly. Recent statistics reveal a notable rise in demand, with mid-level properties now accounting for a substantial share of real estate transactions. Key statistics that define the current market landscape include:

- Average property price within the mid-level segment: R800,000 to R1.5 million.

- Annual growth rate in property values: approximately 5%.

- Vacancy rates for mid-level rentals: around 8%.

- Percentage of first-time home buyers in the mid-level market: 60%.

- Average rental yield for mid-level properties: 7%.

- Number of new developments launched in the past year: 15.

- Proportion of buyers seeking mid-level properties: 40% of the market.

This consistent growth underscores a vibrant market poised for continued expansion. Various factors, including demographic shifts, economic recovery, and advancements in infrastructure, have significantly enhanced the attractiveness of mid-level properties in Witbank. These properties appeal to a diverse array of buyers and investors, presenting an enticing blend of affordability and potential for capital appreciation.

Discovering the Most Sought-After Property Types in Witbank

Witbank boasts a diverse selection of mid-level properties, catering to various market segments, each offering distinct charm and advantages. Among the most favored property types in this category are townhouses, duplexes, and single-family homes, each resonating with buyers and renters for multiple reasons. Townhouses are particularly popular due to their contemporary designs and lower maintenance costs, making them ideal for young professionals and small families seeking a modern living experience. Duplexes also garner significant interest, as they combine space and affordability, facilitating semi-independent living arrangements.

Single-family homes remain a staple of the mid-level segment, especially for families eager to establish themselves in family-oriented neighborhoods. Their appeal is further enhanced by proximity to essential amenities, educational institutions, and recreational facilities. Consequently, these properties consistently attract buyers looking for long-term investments in well-established communities, ensuring a vibrant and flourishing residential environment.

The rental market for mid-level properties has experienced substantial growth, particularly among individuals seeking flexibility without the long-term commitment associated with homeownership. Many young professionals and newlyweds are drawn to rental properties, captivated by the convenience and reduced financial burden they offer. This trend has fostered a competitive rental landscape, where landlords often receive multiple applications for sought-after units, highlighting the strong demand for quality rental options in the area.

Analyzing Price Trends and Affordability in the Mid-level Market

Price trends within the mid-level property market in Witbank reveal the intricate balance between affordability and demand. In recent years, the average price of mid-level homes has steadily risen, with fluctuations influenced by various external factors, including economic conditions and urban development initiatives. Currently, prospective buyers can anticipate spending between R800,000 and R1.5 million for properties within this segment, a price range that continues to attract a diverse array of buyers.

Affordability remains a significant concern for many potential buyers, particularly first-time home purchasers who often struggle with saving for substantial deposits while juggling other financial obligations. The increasing availability of financing options and government initiatives aimed at simplifying the purchasing process have made home ownership more attainable. Programs designed to assist first-time buyers and promote the development of affordable housing effectively address the affordability challenges present in the market.

Although property prices have generally trended upward, the rental market has remained relatively stable. With average rental costs ranging from R6,000 to R10,000 per month, many residents find renting to be a viable option amidst rising property prices. This equilibrium contributes to a healthy property market, allowing both buyers and renters to discover suitable opportunities that align with their needs.

Key Influences Shaping the Mid-level Property Market

Evaluating the Effects of Economic Conditions

The mid-level property market in Witbank is significantly influenced by the region’s economic landscape. A flourishing local economy, marked by a wide range of employment opportunities and increasing income levels, encourages further investment in residential properties. Key economic indicators shaping this market include:

- Employment rates across crucial sectors such as mining, manufacturing, and services.

- Consumer confidence levels impacting purchasing power.

- Interest rates established by the South African Reserve Bank.

- Inflation rates affecting the cost of living and disposable income.

- Government policies aimed at promoting economic growth and stability.

Currently, Witbank enjoys a relatively stable economy, with growing employment opportunities contributing positively to the property market. Residents demonstrate a greater willingness to invest in home ownership when they feel financially secure. However, fluctuations in interest rates may present challenges, particularly for buyers relying on financing options. Overall, a robust economic environment is vital for sustaining growth and attracting investment in the mid-level property sector.

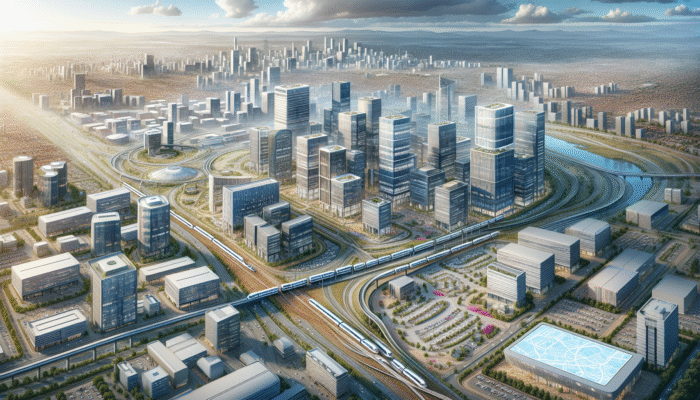

Grasping the Significance of Infrastructure Development

Infrastructure development plays a pivotal role in shaping the mid-level property market in Witbank. Enhanced infrastructure not only improves accessibility but also increases property values, making the area more appealing to prospective buyers. Significant infrastructure projects in recent years have included road improvements, upgrades in public transport, and the establishment of crucial services such as schools and healthcare facilities, all of which are essential for nurturing a thriving community.

These advancements create a ripple effect, as improved infrastructure often results in increased demand for housing. Areas with newly constructed schools or enhanced transport links typically experience an influx of families, intensifying competition for properties in those regions. Furthermore, the government’s commitment to upgrading public amenities fosters a sense of community and enhances the overall quality of life for residents.

As developers recognize these advancements, new housing projects are emerging to meet the growing demand. The strategic planning of urban development in Witbank ensures that mid-level properties are well-positioned to benefit from these infrastructure improvements, resulting in potential long-term capital appreciation for homeowners and investors alike.

Identifying Demographic Changes in Witbank

Demographic shifts in Witbank have a significant impact on the demand for mid-level properties. In recent years, there has been a notable increase in the number of young professionals, families, and immigrants relocating to the area. This demographic transformation has led to diverse housing needs, prompting developers to focus on creating mid-level properties that cater to a variety of lifestyles and preferences.

The millennial generation is particularly influencing the demand for modern, affordable housing options. This demographic tends to prioritize convenience, sustainability, and community involvement, compelling property developers to align their offerings with these expectations. Features such as eco-friendly designs, energy efficiency, and proximity to essential amenities increasingly attract younger buyers who aim to enhance their quality of life.

As families seek safe, well-connected neighborhoods, the demand for mid-level properties continues to rise. This trend has resulted in an evolving property landscape in Witbank, with developers actively responding to the changing needs of the population. Adapting to these demographic shifts will be vital for the mid-level property market’s success in the years to come, ensuring it remains relevant and appealing to prospective buyers and investors.

Assessing the Influence of Government Policies on the Property Market

Government regulations and incentives are crucial in shaping the mid-level property market in Witbank. Numerous policies aim to support and stimulate the housing sector, particularly initiatives focused on increasing home ownership and the availability of affordable housing. These regulations can significantly influence market dynamics, creating opportunities for both buyers and investors.

One notable initiative is the First-Time Home Buyer Grant, which assists eligible individuals in obtaining financial support for their first property purchase. This program has made property ownership more accessible, particularly for lower- and middle-income households. Additionally, the government has introduced policies that encourage developers to construct affordable housing units, promoting a more inclusive property market that caters to a wider demographic.

Compliance with building regulations and zoning laws also impacts the mid-level property market. Developers must navigate these regulations to ensure their projects align with government objectives, which can sometimes delay progress. Nevertheless, proactive government intervention fosters a conducive environment for growth, creating a more dynamic and robust housing sector capable of adapting to the community’s evolving needs.

Identifying Market Trends in the Property Sector

Current trends within the mid-level property market in Witbank indicate a shift towards diversification and innovation. As buyers become more discerning, property developers are responding by offering a broader range of choices, including mixed-use developments and properties featuring integrated technology that enhances the living experience.

Smart home technologies are gaining popularity, with buyers showing interest in properties that provide energy efficiency and automation. Additionally, the movement towards sustainable living is influencing property designs, prompting developers to incorporate eco-friendly materials and practices that align with modern expectations.

Another significant trend is the rise of co-living and shared spaces, appealing to younger buyers and professionals seeking affordability and community engagement. This shift reflects changing lifestyle preferences, as individuals increasingly prioritize shared experiences over traditional home ownership models.

Investors can benefit from these trends by considering properties that align with evolving market demands. By staying informed and adapting to changing preferences, stakeholders can position themselves for success in Witbank’s mid-level property sector, ensuring their investments remain relevant and profitable in the long run.

Expert Perspectives on Mid-level Property Market Trends in Witbank

Thorough Expert Analysis of Market Dynamics

Local experts provide invaluable insights into the dynamics of the mid-level property market in Witbank. According to property analysts, maintaining a balance between supply and demand is essential for sustaining a healthy market. The steady influx of buyers, combined with the limited availability of affordable properties, keeps competition lively and drives prices upward, creating a dynamic and fast-paced environment.

Real estate agents in the area observe that first-time home buyers are particularly active, with many seeking properties in established neighborhoods that offer good amenities and schools. This trend underscores the significance of location, as buyers increasingly prioritize properties that provide a sense of community and accessibility to essential services.

Additionally, local developers are adapting to market demands by focusing on innovative designs and sustainable building practices. Properties that incorporate green technologies or community-oriented features tend to attract both buyers and investors alike. As the market continues to evolve, staying attuned to these dynamics will be critical for anyone looking to successfully navigate the mid-level property landscape in Witbank.

Looking Ahead: Future Projections for Market Trends

Looking forward, projections for the mid-level property market in Witbank indicate a continued upward trajectory, driven by demographic transformations and economic recovery. Experts expect the demand for affordable housing to remain strong, especially as more young professionals enter the market. Growth in employment opportunities across key sectors is anticipated to bolster buyer confidence, resulting in increased investment activity and a vibrant property market.

Investors should consider practical steps to capitalize on these future trends. Identifying emerging neighborhoods with planned infrastructure developments can yield substantial returns. Furthermore, staying informed about government incentives for first-time buyers can help investors align their strategies with prevailing market dynamics, ensuring they seize opportunities as they arise.

Moreover, keeping an eye on shifting buyer preferences will be crucial. Properties that embrace sustainability, technology, and community engagement will likely attract more attention, offering lucrative opportunities for savvy investors. By proactively identifying these trends and adjusting strategies accordingly, investors can position themselves advantageously in Witbank’s mid-level property market, securing their financial future.

Identifying Investment Opportunities in the Mid-level Market

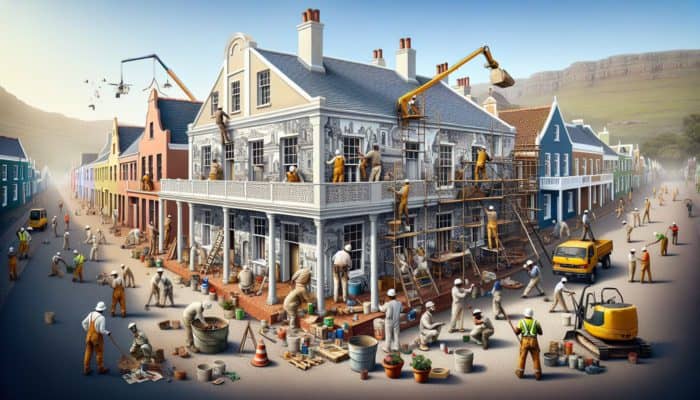

The mid-level property market in Witbank is rich with investment opportunities, especially for those willing to conduct thorough research and analysis. Properties located in up-and-coming areas often offer the best potential for capital appreciation, particularly those situated near new infrastructure projects or essential amenities that enhance living conditions.

Investors should consider diversifying their portfolios by exploring various property types, such as townhouses, duplexes, or multi-family units. These property types frequently yield higher rental returns and cater to a broader tenant base, making them an appealing option for generating passive income over time.

Additionally, identifying properties that require renovation or upgrading can present lucrative opportunities. By adding value through improvements, investors can significantly increase rental yields and property values. Collaborating with local real estate experts can provide valuable insights into the best areas and property types to target for investment, ensuring a successful and profitable venture.

As the market continues to evolve, staying informed about local trends and buyer preferences will be critical for maximizing investment success in Witbank’s mid-level property sector. By adapting to market changes and seizing opportunities, investors can enhance their position and achieve their financial goals.

Understanding the Impact of Economic Factors on Property Values

Economic factors play a pivotal role in shaping mid-level property values in Witbank. Changes in the local economy, such as employment rates, consumer confidence, and interest rates, can directly influence property prices and buyer behavior. A robust economy typically leads to increased housing demand, driving prices higher, while economic downturns can have the opposite effect, presenting challenges for both buyers and sellers.

Local case studies illustrate how fluctuations in interest rates can impact buyer behavior. For example, when interest rates are low, buyers tend to feel more confident, leading to heightened sales activity and rising property values. Conversely, higher rates can dampen demand, causing prices to stagnate or even decline, which may negatively influence market stability.

Furthermore, demographic trends, such as population growth and urbanization, can affect property values. As more individuals migrate to Witbank in search of job opportunities, housing demand is likely to increase, contributing to rising property values. Understanding these economic dynamics is essential for stakeholders aiming to thrive in the mid-level property market, as it informs their investment strategies and decision-making processes.

What Distinguishes the Mid-level Property Market in Witbank from Other Markets?

Contrasting the Mid-level Market with High-end Markets

When comparing the mid-level property market in Witbank to the high-end market within the region, several key distinctions emerge. High-end properties typically command significantly higher prices, often exceeding R2 million, and cater to a wealthier demographic seeking luxury amenities and exclusive locations that offer a prestigious lifestyle.

While high-end properties may provide more spacious designs and upscale finishes, the mid-level market serves as an accessible entry point for many buyers. The mid-level segment appeals to a broader audience, including first-time buyers and young families, thus capturing a larger market share. This inclusivity enhances community diversity and fosters a vibrant living environment.

However, high-end properties often experience slower turnover rates, as buyers in this segment tend to be more selective and discerning. In contrast, mid-level properties benefit from higher demand and quicker sales, making them an attractive choice for investors seeking consistent rental yields. Ultimately, the mid-level market showcases a more dynamic environment, driven by a diverse buyer base and greater flexibility, ensuring its ongoing relevance in the property landscape.

Comparing the Mid-level Market to Low-end Markets

The mid-level property market in Witbank also stands in stark contrast to the low-end market. Properties in the low-end segment are typically priced below R800,000, appealing to budget-conscious buyers and investors. While these affordable properties can present opportunities, they often come with challenges related to quality, maintenance, and potential resale value, which may deter more discerning investors.

In comparison, mid-level properties generally offer superior construction quality, amenities, and overall living conditions. Buyers in the mid-level segment seek a balance between affordability and quality, which they frequently find in well-established neighborhoods with strong community ties. This balance enhances the attractiveness of mid-level properties, ensuring they remain desirable for both buyers and renters.

Moreover, the low-end market may experience higher vacancy rates due to its limited appeal, while mid-level properties typically enjoy greater demand and tenant interest. As a result, investing in mid-level properties may present less risk and more potential for long-term value appreciation than lower-end options, making them a prudent choice for investors aiming for sustainable growth.

Key Factors Influencing Market Positioning

Numerous factors influence the positioning of the mid-level property market in Witbank relative to other markets. Economic conditions, buyer demographics, and infrastructure developments are all critical in determining demand and property values. Understanding these dynamics is essential for investors and stakeholders seeking to make informed decisions.

The availability of financing options is another vital consideration. With government initiatives designed to assist first-time buyers, the mid-level market has become increasingly appealing, attracting potential homeowners away from both high-end and low-end markets. This influx of demand can bolster property values and reduce vacancy rates, fostering a more stable market environment.

Additionally, ongoing infrastructure development, such as enhanced transport links and public amenities, increases the allure of mid-level properties. As more families and professionals seek housing in well-connected areas, the mid-level market benefits from heightened competition and demand, further solidifying its position in the broader property landscape and contributing to its long-term growth potential.

A National Perspective on Mid-level Markets

When comparing the mid-level property market in Witbank to other mid-level markets across South Africa, several trends become apparent. While Witbank boasts a strong local economy and a growing population, other regions may experience differing market dynamics based on unique economic conditions, buyer preferences, and property availability.

For instance, cities like Johannesburg and Pretoria feature more extensive urban developments and a wider selection of property types. However, Witbank offers distinct advantages, including lower property prices and a more relaxed lifestyle, attracting buyers who seek affordability and community engagement without the hustle and bustle of larger urban centers.

Furthermore, the demand for mid-level properties in Witbank may be influenced by regional trends, such as migration patterns and economic growth in surrounding areas. Overall, while the mid-level property market in Witbank shares similarities with national markets, its unique characteristics and advantages make it an attractive option for buyers and investors alike, ensuring its ongoing significance in the South African property landscape.

Strategic Approaches for Investing in Mid-level Properties

Analyzing the Benefits and Drawbacks of Buying versus Renting

When considering mid-level properties in Witbank, prospective buyers often weigh the advantages and disadvantages of purchasing versus renting. Each option presents its own unique set of benefits and challenges. Buying a property offers long-term financial advantages, including the potential for equity growth and property value appreciation. Homeowners enjoy the freedom to customize their living spaces, fostering a sense of ownership and stability without the risk of rental increases associated with leasing agreements.

Conversely, renting offers flexibility and lower initial financial commitments, making it appealing to individuals or families who may not be ready to settle down permanently. Renting can be particularly advantageous for those anticipating changes in their living situations, such as job relocations or lifestyle preferences that necessitate mobility.

Ultimately, the decision between buying and renting will depend on individual circumstances, including financial readiness, lifestyle choices, and long-term objectives. Buyers should thoroughly assess their situations to determine the most suitable approach for their needs in Witbank’s mid-level property market, ensuring they make informed decisions that align with their personal and financial goals.

Choosing Between Long-term and Short-term Investment Strategies

Investors in the mid-level property market in Witbank must choose between long-term and short-term investment strategies. Long-term investments typically involve acquiring properties with the intention of holding them for several years, allowing for appreciation in property values and consistent rental income. This approach is particularly appealing in a market like Witbank, where property values are projected to rise steadily over time, providing a solid foundation for investment growth.

Short-term investments, however, focus on quick returns, often involving property flipping or short-term rentals. While this strategy can yield immediate profits, it carries higher risks, especially in fluctuating markets where demand may be unpredictable. Investors must be well-versed in market trends and property valuation to succeed in this approach, ensuring they can make timely decisions that maximize their returns.

Selecting the appropriate strategy will depend on various factors, including an investor’s financial objectives, risk tolerance, and market knowledge. A well-rounded investment portfolio may incorporate both long-term and short-term strategies, allowing for balanced growth and income generation in Witbank’s mid-level property sector while enhancing the overall investment experience.

Implementing Effective Risk Management Techniques

Investing in mid-level properties in Witbank involves inherent risks, necessitating effective risk management techniques to protect investments. Investors can mitigate potential risks through several strategies, including:

- Diversifying the property portfolio to minimize exposure to market fluctuations and economic downturns.

- Conducting thorough due diligence on properties before purchasing, ensuring informed decision-making.

- Staying informed about market trends, economic indicators, and regulatory changes that may impact investments.

- Utilizing professional property management services to optimize rental income and reduce vacancies, ensuring a consistent cash flow.

- Maintaining a financial reserve to cover unexpected expenses or downturns, thereby enhancing financial resilience amidst market challenges.

By employing these risk mitigation strategies, investors can improve their chances of success in Witbank’s mid-level property market. Assessing various factors and remaining agile in response to market changes will contribute to a more resilient investment strategy, ultimately leading to long-term financial stability and growth in the property sector.

Addressing Challenges in the Mid-level Property Market

Overcoming Regulatory Challenges

The mid-level property market in Witbank faces numerous regulatory hurdles that can impede growth and development. Zoning laws, building codes, and compliance requirements can present challenges for developers and investors seeking to navigate the market effectively. Understanding the regulatory landscape is essential for ensuring successful project implementation and avoiding potential delays.

Stricter lending criteria and regulatory measures related to financing can also affect buyer access to loans, making it more challenging for prospective homeowners to enter the market. These obstacles can lead to slower project approvals and increased costs, ultimately impacting property availability and pricing, which may create difficulties for both buyers and sellers in the marketplace.

Furthermore, ongoing regulatory changes can create uncertainty for investors, necessitating a proactive approach to staying informed about potential impacts on their investments. Understanding and adapting to the regulatory landscape is vital for success in Witbank’s mid-level property market, enabling stakeholders to make informed decisions that align with their investment objectives.

Tackling Market Saturation Issues

Market saturation poses a significant challenge for the mid-level property market in Witbank. As more developers enter the market and new properties are constructed, the increased supply can lead to heightened competition. This saturation may result in slower sales and lower rental yields, particularly in areas experiencing an influx of similar properties that struggle to differentiate themselves in the marketplace.

To combat saturation, it is crucial for developers and investors to identify unique selling propositions that distinguish their properties from competitors. Emphasizing innovative designs, desirable locations, and added amenities can help attract buyers and tenants even in a saturated market, ensuring properties stand out and retain their value.

Additionally, understanding local market demand and trends can aid in making informed decisions regarding property investments. By remaining vigilant and adaptable to changing circumstances, stakeholders can effectively navigate the challenges posed by market saturation, helping to ensure the long-term viability of their investments in Witbank’s mid-level property sector.

Managing Economic Fluctuations

Economic fluctuations present a continuous challenge for the mid-level property market in Witbank. Changes in economic conditions, such as employment rates, inflation, and interest rates, can directly impact property values and buyer behavior. For instance, an economic downturn may lead to diminished consumer confidence, resulting in reduced demand for housing and lower property sales, which can negatively affect market stability.

Investors must be prepared to adjust their strategies in response to economic fluctuations. Developing a thorough understanding of local economic indicators and trends will empower stakeholders to make informed decisions regarding property investments. Additionally, maintaining flexible investment strategies can help mitigate risks associated with economic uncertainty, ensuring long-term sustainability and success in Witbank’s mid-level property market.

Research-Driven Advantages of Mid-level Property Market Trends in Witbank

Enhancing Residents’ Quality of Life

Emerging trends in the mid-level property market in Witbank significantly contribute to improved quality of life for residents. As developers respond to increasing demand by creating modern, well-designed properties, buyers benefit from enhanced living conditions and access to essential amenities that enrich their daily lives.

Properties located in thoughtfully planned neighborhoods often provide proximity to schools, parks, and shopping centers, promoting a sense of community and encouraging social engagement among residents. This not only benefits individual residents but also elevates the overall quality of life in Witbank, fostering vibrant and interconnected communities.

Moreover, the focus on sustainability within the mid-level property market can lead to reduced utility costs and environmental benefits, further enhancing residents’ overall quality of life. By leveraging these trends, stakeholders can create neighborhoods that prioritize well-being and community development, fostering a positive living environment for all.

Fostering Economic Growth in the Region

The mid-level property market in Witbank plays a pivotal role in driving economic growth in the region. As more individuals invest in mid-level properties, increased construction and development can create job opportunities and stimulate local businesses, thereby contributing to the overall economic landscape and prosperity of the area.

The arrival of new residents generates demand for services and amenities, promoting economic diversification and strengthening the local economy. As the property market flourishes, it creates a cycle of growth that supports Witbank’s overall economic landscape. Stakeholders in the property market can leverage this momentum to capitalize on emerging opportunities and drive further investment in the region, fostering sustainable economic development.

Encouraging Community Development Initiatives

Mid-level property market trends in Witbank promote community development and social cohesion. As new properties are developed and occupied, residents often engage with one another and participate in local initiatives, reinforcing community ties and fostering a sense of belonging.

The establishment of communal spaces, parks, and recreational facilities within mid-level developments encourages social interaction and collaboration among residents. This sense of community fosters a welcoming atmosphere, enhancing residents’ quality of life and overall satisfaction, which is crucial for the long-term sustainability of neighborhoods.

Furthermore, as more engaged residents invest in their neighborhoods, property values are likely to rise, creating a positive feedback loop that benefits everyone involved. By prioritizing community development, the mid-level property market in Witbank can significantly contribute to the social fabric of the region, ensuring its continued growth and prosperity.

Envisioning Future Prospects for Mid-level Properties in Witbank

Identifying Emerging Trends

The future of the mid-level property market in Witbank is ripe with exciting developments, with several emerging trends on the horizon. As the demand for affordable housing continues to rise, developers are likely to focus on crafting innovative designs and diverse property types that cater to a broader audience, ensuring inclusivity in the housing market.

Smart home technologies and energy-efficient designs are expected to become increasingly prevalent, appealing to environmentally conscious buyers who prioritize sustainability. Moreover, the trend of co-living and shared spaces may gain traction as younger generations seek flexibility and affordability in housing, reflecting changing lifestyle preferences that favor community-oriented living arrangements.

In light of these trends, investors and developers should be prepared to adjust their strategies, embracing the evolving needs of the market. By staying attuned to emerging trends and incorporating innovative approaches in their developments, stakeholders can position themselves favorably for future success in Witbank’s mid-level property sector, ensuring relevance in an ever-changing landscape.

The Technological Transformation of the Property Market

The influence of technology on the mid-level property market in Witbank is profound. As more buyers and investors turn to digital platforms for property searches and transactions, the real estate landscape is undergoing a transformation. Virtual tours, online listings, and advanced marketing techniques allow buyers to explore properties from the comfort of their homes, streamlining the purchasing process and enhancing the overall buying experience.

Additionally, property management technologies are becoming increasingly prevalent, enabling landlords to optimize their operations and enhance tenant experiences through efficient communication and maintenance processes. Smart home features, such as energy monitoring and automated systems, are also attracting buyers looking for modern living solutions that cater to their technologically savvy lifestyles.

Embracing technology will be essential for stakeholders aiming to flourish in Witbank’s mid-level property market. By harnessing the power of innovation and integrating technology into their offerings, investors and developers can create value-added experiences for buyers and residents alike, ensuring success in a competitive landscape.

Embracing Sustainability and Green Initiatives

Sustainability and green initiatives are set to significantly influence the future of the mid-level property market in Witbank. As environmental concerns gain prominence, buyers increasingly prioritize properties that adopt eco-friendly practices. Developers are responding by incorporating sustainable building materials, energy-efficient designs, and renewable energy sources into their projects, aligning with contemporary consumer preferences.

The rise of green living not only benefits the environment but also enhances the appeal of properties to prospective buyers. Properties that promote sustainability often command higher prices and attract a dedicated buyer base, ensuring that investments remain lucrative over time.

By integrating sustainability into property development, stakeholders can contribute to a more environmentally conscious community while capitalizing on the growing market demand. As the mid-level property market in Witbank evolves, embracing green initiatives will be crucial for long-term success and relevance in the industry, ensuring that developments meet the needs of future generations.

Frequently Asked Questions

What are the average prices for mid-level properties in Witbank?

Average prices for mid-level properties in Witbank range from R800,000 to R1.5 million, depending on location and property type, making them accessible to a broad range of buyers.

How has the demand for mid-level properties changed recently?

Demand for mid-level properties in Witbank has increased due to economic recovery and a growing population, particularly among first-time buyers and young professionals seeking affordable housing options.

What types of properties are most popular in the mid-level market?

Popular property types in the mid-level market include townhouses, duplexes, and single-family homes, each appealing to different demographics and lifestyle preferences, ensuring a diverse housing market.

What factors influence property values in Witbank?

Key factors influencing property values in Witbank include economic conditions, infrastructure development, demographic shifts, and government policies aimed at promoting housing accessibility and affordability.

Are there any government incentives for first-time home buyers in Witbank?

Yes, the government offers various incentives, including grants for first-time home buyers, aimed at making property ownership more accessible and encouraging investment in the housing market.

How does the mid-level market in Witbank compare to high-end markets?

The mid-level market offers more affordable options for buyers, while high-end markets command significantly higher prices and cater to wealthier demographics seeking luxury living experiences.

What investment strategies are recommended for mid-level properties?

Investors should consider both long-term and short-term strategies, diversify their portfolios, and stay informed about market trends to maximize returns and mitigate risks effectively.

What are the main challenges facing the mid-level property market?

Challenges include regulatory hurdles, market saturation, economic fluctuations, and changing buyer preferences, all of which can impact growth and investment opportunities in the property sector.

How do demographic shifts affect the property market in Witbank?

Demographic shifts, such as an influx of young professionals and families, increase demand for mid-level properties and influence the types of developments being built to meet evolving lifestyle needs.

What role does technology play in the property market?

Technology streamlines property searches and transactions, enhances property management efficiency, and drives demand for smart homes, ultimately shaping the future of the mid-level property market.

Explore our content on YouTube!

The Article Mid-level Property Market Trends in Witbank: Insights First Published On: https://revolvestate.com

The Article Property Market Trends in Witbank: Mid-Level Insights Was Found On https://limitsofstrategy.com