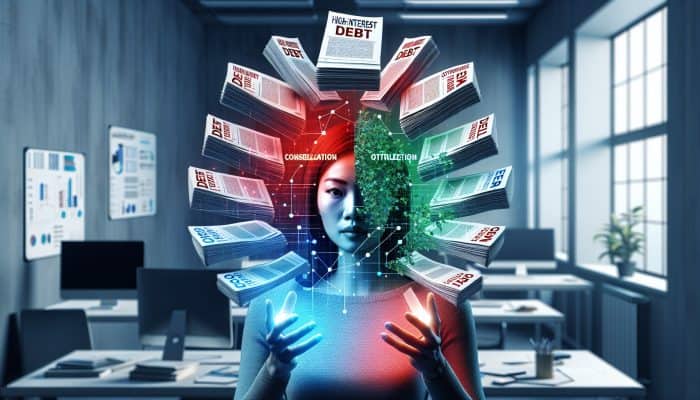

Understanding the Impact of Rising Interest Rates on Your Debt Consolidation Approach Delving into the realm of debt consolidation can seem like a promising solution for individuals ensnared in a relentless cycle of mounting debt. However, it is crucial to evaluate this option with a critical mindset, as the outcomes can be unpredictable and complex….

Essential Guide to Spotting Shady Debt Consolidation Lenders

Verify FCA Registration to Ensure Safe and Reliable Lending Practices When you are in need of financial assistance, it is absolutely essential to learn how to identify shady debt consolidation lenders. The primary and most crucial step in this process involves confirming the lender’s FCA registration. The Financial Conduct Authority (FCA) is the UK regulatory…

Debt Consolidation Terms Explained: A Guide for Beginners

Unlock Financial Freedom Through Effective Debt Consolidation Strategies Debt consolidation serves as a vital solution for individuals grappling with the pressures of managing numerous debts. Imagine the peace of mind that comes with combining all your financial obligations into a single, streamlined payment, often accompanied by a much lower interest rate. This approach not only…

Debt Consolidation Strategies for Small Business Success

Boost Your Business Acumen with Essential Insights on Debt Consolidation Mastering the Core Principles of Debt Consolidation Debt consolidation is a robust financial strategy specifically designed for small business owners, enabling them to combine various debts into a single loan. This method streamlines the repayment process and allows entrepreneurs to manage their cash flow more…

Debt Consolidation Loan Organizers: A Complete Guide

Your Comprehensive Guide to Mastering Debt Consolidation in the UK For individuals struggling with multiple financial commitments, debt consolidation presents a viable path to financial relief. This strategy is particularly appealing for those burdened by various debts, including credit cards, personal loans, and other financial responsibilities. The concept of merging these debts into a single,…

Debt Consolidation: Achieve Financial Peace for Better Sleep

Your Comprehensive Guide to Mastering Debt Consolidation Strategies in the UK Exploring Debt Consolidation: Key Insights for Achieving Financial Freedom Debt consolidation serves as an effective financial strategy that allows individuals to combine multiple debts into a single loan, which is easier to manage. This approach often comes with a significantly lower <a href=”https://www.debtconsolidationloans.co.uk/debt-consolidation-with-variable-interest-rates-a-guide/”>interest rate</a>,…

Debt Consolidation Loan Myths: Truths You Should Know

Discover the Transformative Advantages of Debt Consolidation Loans for Superior Financial Management Debt consolidation loans have swiftly become an essential financial tool for individuals facing the challenges of juggling multiple debts. These loans empower borrowers to merge various financial responsibilities into a singular, more manageable payment, often accompanied by a reduced interest rate. This approach…

Tax Debt Consolidation: Your Ultimate Essential Guide

Maximizing the Advantages of Tax Debt Consolidation in the UK Comprehending the Fundamentals of Tax Debt Consolidation Mastering the Art of Tax Debt Consolidation: Tax debt consolidation serves as a strategic financial solution that empowers taxpayers to amalgamate multiple tax liabilities into a single, streamlined payment plan. This approach simplifies the journey of repayment by…

Credit Counseling vs. Consolidation Loans: Quick Insights

Achieving Financial Success Through Expert Credit Counseling and Consolidation Loans Unlock Financial Empowerment with Effective Credit Counseling Credit counseling is a carefully structured process designed to help individuals manage their debt effectively. Clients work closely with certified professionals who guide them in developing actionable strategies that enhance their financial wellbeing. Through personalized, one-on-one consultations, clients…

Debt Consolidation Strategies for Retirees: A Helpful Guide

Comprehensive Insights into Effective Debt Consolidation Techniques for Retirees Exploring the Fundamentals of Debt Consolidation for Financial Clarity Debt consolidation represents a strategic financial method that empowers individuals, particularly retirees, to combine several outstanding debts into one single loan. This is usually achieved at a more favorable interest rate, which can significantly ease the burden…