Your cart is currently empty!

Category: Finance & Business

-

Debt Consolidation Success: Inspiring Personal Stories from the UK

Effective Debt Consolidation Techniques in the UK for Achieving Financial Independence

Understanding Debt Consolidation: Definition and Process

Debt consolidation refers to a strategic financial approach designed to combine multiple outstanding debts into a single loan, typically featuring a lower interest rate. This method not only simplifies the repayment process but also empowers individuals to handle their financial obligations more effectively. Within the UK, this approach has become increasingly popular among those seeking to alleviate the stress associated with various debts. The types of debt that individuals often consolidate in the UK comprise:

- Credit card debt

- Personal loans

- Store card debts

- payday loans

- <a href="https://limitsofstrategy.com/debt-consolidation-boosting-confidence-in-the-uk/">overdrafts</a>

- Unsecured loans

- Utility bills in arrears

- Medical debt

Given the increasing financial pressures many face today, acquiring a comprehensive understanding of debt consolidation is critical for regaining financial stability and achieving lasting peace of mind.

Analyzing the Current Personal Debt Landscape in the UK

The present situation regarding personal debt in the UK raises significant concerns, as total household debt has escalated to around £1.7 trillion. This alarming figure can be attributed to multiple factors, such as stagnant wages, rampant inflation, along with the escalating costs of living, which have left many individuals struggling to meet their repayment obligations. Recent research shows that a considerable portion of the population feels overwhelmed by their financial responsibilities, frequently resorting to borrowing additional funds to manage existing debts. The repercussions of the COVID-19 pandemic have only intensified these financial hardships, leading to job losses and reduced income levels, thereby increasing reliance on credit. Consequently, the urgency for effective solutions like debt consolidation has never been more critical.

Exploring the Benefits of Debt Consolidation in the UK

In the current economic climate of the UK, considering debt consolidation can offer a practical and beneficial avenue toward achieving financial relief. By combining various debts, individuals can potentially secure lower interest rates and more straightforward repayment plans. This can significantly reduce monthly financial pressures, allowing for improved budgeting and enhanced cash flow management. Furthermore, successful debt consolidation can lead to a positive impact on credit scores over time, as individuals demonstrate consistent repayment on a single loan, rather than managing multiple accounts. This strategy not only represents a method to regain control over one’s finances but also fosters a sense of security during challenging economic times.

Inspiring Personal Accounts of Debt Consolidation Success

Uplifting Transformation Stories from UK Residents

Throughout the UK, countless individuals have successfully transformed their financial situations through effective debt consolidation strategies. Take Sarah, for instance, a 35-year-old teacher from Manchester, who faced overwhelming credit card debt that threatened her financial stability. After consulting with a debt consolidation expert, she successfully merged her credit card debts into a single personal loan with a significantly lower interest rate. The emotional relief she experienced was profound; Sarah remarked that this process not only simplified her financial obligations but also restored her confidence in managing her finances effectively.

Similarly, Mark, a 42-year-old engineer from Birmingham, encountered challenges due to multiple loans, including a personal loan and several outstanding credit card balances. By consolidating these debts into one manageable loan, Mark was able to reduce his monthly payments, enabling him to save for emergencies while effectively repaying his debt. These success stories underscore the transformative potential of debt consolidation, illustrating how it can offer both emotional and financial relief to those burdened by debt.

Overcoming Challenges on the Path to Success

Many inspiring narratives surrounding debt consolidation in the UK highlight individuals overcoming significant obstacles before seeking assistance. High interest rates often acted as a common barrier, trapping many borrowers in a relentless cycle of debt that appeared impossible to escape. For example, Sarah’s initial struggles with credit card debt were exacerbated by soaring annual percentage rates (APRs), which deepened her financial distress. Additionally, the stress of creditor harassment added to the emotional burden, hindering individuals’ focus on achieving a resolution.

Moreover, those who successfully consolidated their debts often had to confront the stigma associated with financial hardship. Societal pressures to maintain an image of financial wellness frequently discouraged individuals from seeking help sooner. By openly discussing their challenges and collaborating with financial professionals, these individuals not only tackled their debts but also emerged as advocates for financial literacy and debt awareness, inspiring others who may be facing similar struggles.

The Role of Experts in Guiding Their Success Journey

Financial advisors and debt consolidation services play a pivotal role in guiding individuals through the complexities of debt management. In Sarah’s case, an advisor conducted a thorough review of her finances, meticulously identifying her debts while analyzing her income and expenditures. This comprehensive examination facilitated the creation of a personalized consolidation plan tailored to her unique circumstances.

Experts often provide actionable strategies that empower individuals to regain control over their financial situations. For example, they may recommend budgeting tools, suggest suitable consolidation loans, or offer negotiation tactics with creditors. Additionally, ongoing support and guidance can help individuals adhere to their repayment plans. By leveraging expert assistance, many have discovered not only a pathway to financial freedom but also a deeper understanding of financial principles, equipping them with the necessary tools to avoid future financial setbacks.

Comprehensive Overview of Debt Consolidation Mechanics in the UK

A Step-by-Step Approach to Debt Consolidation Application

Embarking on the debt consolidation journey in the UK involves a structured series of steps designed to ensure individuals make informed financial choices. The process typically begins with a thorough assessment of one’s financial situation, including compiling a detailed list of all current debts, sources of income, and expenses. Gaining clarity on these aspects is crucial for identifying the most effective consolidation strategy. The steps usually involved are:

- Conducting a detailed evaluation of all debts and financial obligations

- Researching available debt consolidation options and lenders

- Consulting with a financial advisor or debt consolidation service

- Submitting an application for a suitable consolidation loan

- Utilizing the funds to pay off existing debts

- Establishing a manageable repayment plan for the new consolidated loan

- Monitoring progress and adjusting budgeting strategies as needed

This systematic approach not only simplifies the debt repayment process but also encourages the development of healthier financial habits moving forward.

Exploring Different Loan Types for Debt Consolidation

In the UK, various types of loans can be utilized for debt consolidation, each presenting distinct benefits and considerations. Personal loans are among the most common choices, as they typically feature fixed interest rates and predictable monthly payments. This characteristic can be particularly advantageous for those aiming to manage their finances more effectively.

Home equity loans, which allow homeowners to borrow against the value of their property, also present a feasible option. However, this method carries inherent risks; failure to repay could result in losing one’s home. Another alternative is balance transfer credit cards, which provide an interest-free introductory period, enabling borrowers to pay off debts without incurring additional interest. Each of these options comes with different eligibility criteria and potential risks, making it essential for individuals to carefully evaluate their choices before proceeding.

Understanding Common Eligibility Requirements for Consolidation Loans

Eligibility criteria for debt consolidation loans in the UK generally vary based on the type of loan and lender, yet certain common factors are consistently assessed. A primary determinant is the applicant’s credit score. Most lenders require a minimum credit score for qualification, as this reflects the applicant’s creditworthiness and repayment history.

Income is another critical factor in determining eligibility. Lenders typically evaluate whether the applicant’s income is adequate to cover both existing debts and the new consolidated loan payments. Additional considerations may include current debt levels and job stability. Grasping these criteria is essential for those contemplating debt consolidation, as it sets realistic expectations and better prepares individuals when approaching lenders.

Key Advantages of Debt Consolidation

Debt consolidation in the UK offers several significant advantages that can greatly enhance an individual’s financial well-being. Firstly, one of the most compelling benefits is the potential for lower interest rates. Consolidating debts into a single loan often allows individuals to secure a lower overall interest rate, leading to substantial savings over time. This is particularly beneficial for those dealing with high-interest credit cards or loans.

Secondly, debt consolidation streamlines payment schedules. Managing multiple debts can be overwhelming; yet, merging them into one monthly payment alleviates the mental burden associated with tracking various due dates and amounts. This simplified approach not only reduces stress but also allows individuals to maintain better control over their financial health. Furthermore, successfully consolidating and repaying debts can positively influence credit scores, which are essential for future borrowing opportunities.

Potential Risks and Drawbacks of Debt Consolidation

While debt consolidation can provide significant relief, it is not without potential risks and downsides. One notable concern is the possibility of extending the loan term. Although this may lead to lower monthly payments, it can ultimately result in higher overall interest payments throughout the loan’s duration. Additionally, if individuals do not modify their spending habits, they may find themselves accumulating new debts while still trying to manage the consolidated loan, creating a potentially inescapable cycle of borrowing.

Another risk relates to hidden fees or charges associated with certain consolidation loans. Borrowers must carefully review the terms and conditions before committing to a loan, ensuring they fully comprehend all potential costs involved. Ultimately, individuals must maintain discipline in their financial behaviors post-consolidation; otherwise, they risk reverting to the same patterns that contributed to their initial debt challenges.

Examining the Benefits of Debt Consolidation in the UK

How Lower Interest Rates Can Improve Your Financial Landscape

One of the most significant advantages of debt consolidation is the potential for lower interest rates. Many individuals in the UK find themselves managing high-interest credit card debts or rapidly accumulating loans, which can create substantial financial strain. By consolidating these obligations into a single loan with a reduced interest rate, borrowers can realize significant savings over time. For example, switching from a credit card with a 20% interest rate to a loan at 10% can lead to considerable financial relief and expedite debt repayment.

Furthermore, lower interest rates can enhance cash flow, allowing individuals to allocate more resources toward savings or investments. This newfound financial flexibility can contribute to overall stability, making it easier for borrowers to plan for future expenses or unexpected emergencies. Ultimately, the prospect of reduced interest rates serves as a compelling motivation for many individuals considering debt consolidation.

The Importance of Simplified Payment Structures

Consolidating debt results in simplified payment schedules, significantly alleviating the complexity of managing numerous financial obligations. This streamlined approach can dramatically reduce stress and enhance financial organization. Individuals no longer need to remember multiple due dates or payment amounts; instead, they can focus on a single monthly payment. This simplification often leads to fewer missed payments, positively impacting credit scores over time.

To illustrate the benefits of simplified payments, consider these key advantages:

- Reduced confusion regarding due dates

- Lower risk of missed payments and associated penalties

- Improved budgeting and cash flow management

- Increased peace of mind regarding financial obligations

These benefits reinforce the notion that clarity and simplicity in financial management can significantly contribute to long-term financial health and well-being.

The Connection Between Debt Consolidation and Improved Credit Scores

Successfully consolidating and repaying debt can lead to enhanced credit scores, a crucial aspect of financial health in the UK. Credit scores are influenced by various factors, including payment history, credit utilization, and the diversity of credit types. By consolidating debts and consistently making timely payments, individuals can improve their credit profiles.

A higher credit score opens doors to better financial opportunities, such as lower interest rates on future loans and increased approval chances for credit applications. For many UK residents, the journey toward debt consolidation is not solely about alleviating immediate financial burdens; it also lays the groundwork for a more secure financial future. The relationship between adept debt management and credit scores underscores the necessity of taking proactive steps toward achieving financial wellness.

Effective Strategies for Success in Debt Consolidation

Key Strategies Contributing to Their Success

Successful debt consolidation often relies on strategic planning and disciplined execution. Individuals who have triumphed in their consolidation endeavors typically adopted a combination of approaches that set them on the path to financial health. For instance, establishing clear financial goals is a foundational strategy. By defining specific targets—such as eliminating a certain amount of debt by a specific deadline—individuals create actionable steps toward achieving those objectives.

Budgeting also plays a vital role in this process. Creating a realistic budget that encompasses both living expenses and repayment obligations empowers borrowers to make informed financial choices. Monitoring spending and identifying areas for potential reductions further enhances the ability to direct funds toward debt repayment. Additionally, maintaining open communication with creditors can lead to negotiation opportunities, such as lower interest rates or extended payment terms.

Finally, seeking support from financial advisors or debt management services can provide invaluable insights into effective consolidation strategies. These professionals often offer tailored advice that aligns with individual circumstances, fostering a sense of accountability and motivation throughout the process.

How to Choose the Right Consolidation Plan for Your Needs

Selecting the most appropriate debt consolidation plan in the UK can be challenging given the multitude of available options. It is critical for individuals to assess their unique financial situations and objectives before making a decision. One of the initial steps involves comparing various loan products and lenders, scrutinizing factors such as interest rates, fees, and repayment terms. Gathering recommendations or reviews from trusted sources can also aid in identifying reputable lenders.

Moreover, conducting a thorough assessment of personal financial health is essential. Understanding one’s credit score and its implications for loan eligibility can help set realistic expectations when exploring consolidation options. Individuals should evaluate their cash flow and the practicality of monthly payments to ensure they do not overextend themselves financially.

Finally, consulting with a debt advisor can provide clarity on the most suitable consolidation plan. These experts can outline the pros and cons of each option, ensuring that borrowers make informed decisions that align with their long-term financial aspirations.

Avoiding Common Pitfalls During Debt Consolidation

While the debt consolidation process can be advantageous, there are pitfalls that individuals should be cautious about. One significant mistake is failing to address underlying spending habits. If borrowers do not change their financial behaviors, they risk accruing new debts even after consolidation. This scenario can lead to a cycle of borrowing that exacerbates financial challenges.

Additionally, individuals should avoid making hasty decisions regarding consolidation without thorough research. Entering into a loan agreement without fully understanding the terms, fees, and potential risks can result in unforeseen consequences. It is crucial to meticulously review the fine print and ask questions before committing to any consolidation plan.

Another common error is neglecting to seek professional guidance. While some may feel confident navigating the consolidation process independently, enlisting the help of financial advisors can offer valuable insights and support. These experts can assist in identifying the most effective strategies for debt management and guide individuals toward making sound financial choices.

Maintaining Financial Discipline After Debt Consolidation

Sustaining financial discipline following debt consolidation is vital for achieving long-term success. One effective strategy involves establishing a detailed budget that accounts for both fixed and discretionary expenses. By allocating specific amounts for savings and debt repayment, individuals can ensure they stay on track with their financial goals.

Regularly reviewing financial progress is another essential practice. Designating time each month to assess income, expenditures, and outstanding debts can help individuals maintain accountability and make informed adjustments as needed. This reflection reinforces positive practices and highlights areas where further improvements can be made.

Lastly, cultivating a mindset of financial literacy can empower individuals to make better decisions moving forward. Engaging with resources such as financial blogs, podcasts, or workshops can deepen understanding of personal finance, equipping individuals with the knowledge necessary to navigate future financial challenges confidently.

Real-Life Success Stories of Debt Consolidation

Hearing about the successes of others can serve as a powerful motivator for those considering debt consolidation. For instance, Claire, a 30-year-old nurse from London, faced significant student loan and credit card debt. Through a dedicated debt consolidation strategy, she successfully merged her debts into a single manageable loan, greatly reducing her monthly payments. Claire’s journey exemplifies how proactive measures can lead to positive outcomes, inspiring others to explore similar paths.

In a similar example, David, a small business owner in Liverpool, struggled with multiple loans that hindered his business’s growth. After successfully consolidating his debts, he not only improved his financial situation but also reinvested in his business, resulting in increased revenue. These case studies highlight the transformative potential of debt consolidation, motivating others to pursue their own financial liberation.

In-Depth Analysis of Debt Consolidation Experiences in the UK

Case Study: A Young Professional’s Journey Through Debt Consolidation

Emily, a 27-year-old marketing executive based in Bristol, exemplifies the path of a young professional navigating the challenges of debt consolidation. After accruing substantial student loans and credit card debt, Emily found herself overwhelmed by mounting financial pressures. In her quest for assistance, she consulted a debt advisor who guided her in assessing her financial landscape.

With the advisor’s expertise, Emily consolidated her debts into a personal loan with a lower interest rate, significantly reducing her monthly financial burden. This consolidation not only simplified her payments but also allowed her to focus on saving for future goals, such as homeownership. Emily’s experience serves as a testament to the power of taking proactive steps toward achieving financial well-being.

Case Study: A Family’s Debt Consolidation Journey

The Wilson family, residing in Newcastle, encountered financial strain following unexpected medical expenses. Both parents, employed full-time, found it increasingly challenging to manage their existing debts alongside new financial responsibilities. After exploring various options, they opted for debt consolidation. By consolidating their debts into a single loan, they reduced their interest rates and streamlined their repayment structure.

This decision led to substantial improvements in their family dynamics. The reduction in financial stress fostered enhanced communication and collaboration in managing household finances. Consequently, the Wilsons not only regained control over their financial situation but also strengthened their family bonds through shared financial goals.

Lessons Learned from Debt Consolidation Experiences

The success stories of individuals and families who have undergone debt consolidation in the UK emphasize several valuable lessons. Firstly, the importance of seeking professional guidance cannot be overstated; tailored support can offer clarity and direction in navigating financial obstacles. Furthermore, establishing a clear plan and setting achievable targets are crucial for maintaining motivation throughout the process.

Another essential takeaway is the necessity of changing spending habits. Individuals who successfully navigate debt consolidation often highlight the significance of financial discipline and effective budgeting. Lastly, these narratives reinforce the idea that debt consolidation can act as a stepping stone toward greater financial literacy and empowerment, equipping individuals with the skills necessary to manage their finances adeptly in the future.

The Impact of Debt Consolidation on UK Households

Enhancing Financial Stability Following Consolidation

Debt consolidation can significantly enhance financial stability for households in the UK. By simplifying repayment processes and lowering monthly payments, families can cultivate a more manageable financial environment. This newfound stability often translates into an enhanced quality of life, as individuals can direct funds toward essential living expenses, savings, and even leisure activities.

Moreover, the psychological benefits of financial stability are profound. Many families report a noticeable decrease in stress and anxiety associated with financial pressures, leading to improved overall well-being. The ability to manage finances effectively instills a sense of control, empowering families to plan for the future with confidence.

The positive effects of financial stability extend beyond individual households; they contribute to the broader economic health of communities. When families are less burdened by debt, they tend to spend more on goods and services, stimulating local economies and fostering growth.

The Transformative Effect of Debt Consolidation on Family Dynamics

Debt consolidation can deeply reshape family dynamics in the UK. The financial strain often associated with multiple debts can lead to stress and tension within households. By consolidating debts, families can relieve the burden of financial anxiety, fostering improved relationships and communication.

For instance, parents who successfully consolidate their debts often find they can engage more openly with their children regarding money management. This newfound transparency promotes financial literacy among younger family members, equipping them with invaluable skills for the future. Furthermore, the shared experience of overcoming financial challenges can bring families closer together, reinforcing the importance of teamwork and collaboration.

Overall, the positive impacts of debt consolidation extend to family dynamics, creating a more harmonious home environment and instilling a sense of shared purpose in achieving financial goals.

Long-Term Advantages of Debt Consolidation for UK Residents

The long-term benefits of debt consolidation for UK residents are diverse and far-reaching. Financially, individuals who successfully consolidate and repay their debts frequently experience improved credit scores, allowing them to access better financial products and services in the future. This enhanced creditworthiness can lead to lower interest rates on mortgages, personal loans, and credit cards, resulting in considerable savings over time.

Beyond financial implications, individuals often report enhanced mental well-being following successful debt consolidation. The relief from financial pressure can foster a more optimistic outlook on life, improving overall quality of life. As individuals gain control over their finances, they frequently feel empowered to pursue new opportunities, such as investing in education, starting a business, or saving for significant life events.

Ultimately, the long-term advantages of debt consolidation extend well beyond immediate financial relief, influencing various aspects of life and paving the way for greater financial independence.

Economic Ramifications of Debt Consolidation for the UK Market

Debt consolidation can have significant economic implications for the broader UK market. As more individuals successfully consolidate their debts, the resulting decrease in financial strain can lead to increased consumer spending. With greater disposable income, families are more likely to invest in local businesses, thereby stimulating economic growth and contributing to job creation.

Moreover, the trend toward debt consolidation can shape lending practices. As financial institutions recognize the growing demand for consolidation loans, they may adjust their offerings to better meet consumer needs. This responsiveness can lead to more favorable loan terms and conditions, ultimately benefiting borrowers in the long run.

Additionally, the promotion of responsible borrowing and financial education through debt consolidation initiatives can foster a more financially literate society. As individuals become better informed about managing debt, they are less likely to fall into cycles of borrowing that can adversely affect the economy. This shift can cultivate a culture of financial responsibility, ultimately benefiting both individuals and the wider market.

Looking Ahead: The Future of Debt Consolidation in the UK

Emerging Trends in Debt Consolidation

The landscape of debt consolidation in the UK is evolving, influenced by economic conditions and the availability of financial products. One emerging trend is the rise of digital debt consolidation services that leverage technology to simplify the application process. By providing users with instant access to loan options and enabling quick comparisons, these services enhance accessibility for borrowers.

As awareness of mental health and financial wellness increases, more individuals are recognizing the importance of addressing debt as a core aspect of overall well-being. This shift toward holistic financial management is likely to drive further interest in debt consolidation as an effective solution.

As economic conditions continue to fluctuate, the demand for effective debt management strategies will remain high. Understanding these trends will be vital for individuals seeking to navigate their financial futures successfully.

Strategies for Improving Debt Management Practices in the UK

Enhancing debt management in the UK requires a comprehensive approach involving both individual and systemic changes. For individuals, boosting financial literacy through educational initiatives can empower them to make informed decisions regarding debt. Schools, community organizations, and financial institutions can collaborate to provide resources and workshops that equip individuals with essential money management skills.

On a systemic level, financial institutions can play a crucial role in improving access to debt consolidation options. Offering more transparent terms and conditions, as well as tailored products for diverse financial situations, can help borrowers find solutions that meet their needs. Moreover, policymakers can advocate for regulations that protect consumers from predatory lending practices, ensuring that debt consolidation remains a viable and ethical solution for those in need.

Significance of Financial Education in Debt Consolidation Success

Financial education is crucial for achieving successful debt consolidation outcomes in the UK. An informed populace is better equipped to navigate the complexities of debt management, make sound financial decisions, and avoid common pitfalls. Educational programs focusing on budgeting, understanding credit, and the implications of debt can foster a culture of financial responsibility.

Moreover, financial education initiatives should extend beyond formal settings. Community workshops, online resources, and peer support groups can provide valuable information and encouragement to individuals facing debt challenges. As more people become aware of their options and the significance of financial literacy, the overall success of debt consolidation efforts in the UK is likely to improve.

Impact of Regulatory Changes on Debt Consolidation

Regulatory changes in the UK can significantly influence debt consolidation practices and consumer protections. Recent reforms have aimed at increasing transparency in lending and reducing the risk of predatory lending. This trend toward regulation is encouraging, as it strives to protect vulnerable borrowers from falling into cycles of unmanageable debt.

As the regulatory landscape evolves, it is crucial for both borrowers and lenders to stay informed about changes that may affect their options. Greater awareness of consumer rights can empower individuals to make better choices regarding debt consolidation and protect themselves from exploitative practices. Continued advocacy for fair lending practices will be vital in ensuring that debt consolidation remains a viable solution for those in need.

Technological Innovations Shaping Debt Consolidation

Technological advancements are revolutionizing the debt consolidation landscape in the UK. Fintech companies are developing innovative solutions that streamline the debt consolidation process, making it more accessible to consumers. Online platforms allow individuals to compare loan options quickly, simplifying the decision-making process.

Moreover, technology is enhancing the management of outstanding debts. Mobile applications that track expenses, set budgets, and remind users of payment dates can help individuals stay on top of their financial obligations. These tools empower consumers to take an active role in their financial management, reducing the likelihood of missed payments and further debt accumulation.

As technology continues to advance, debt consolidation services are expected to become increasingly user-friendly and tailored to meet the diverse needs of borrowers. Embracing these innovations will be essential for individuals seeking effective solutions to their financial challenges.

Common Questions About Debt Consolidation

What is debt consolidation?

Debt consolidation is the process of merging multiple debts into a single loan with a lower interest rate, thereby simplifying repayment and financial obligations.

How can debt consolidation benefit me?

It can lead to lower interest rates, simplify your payments, and improve your credit score over time, resulting in greater financial stability and control over your finances.

What types of debts can be consolidated?

Common debts that can be consolidated include credit card debt, personal loans, payday loans, and overdrafts.

What is the typical process for consolidating debt?

The process includes assessing your financial situation, researching loan options, consulting with experts, and applying for a consolidation loan that fits your needs.

Are there risks associated with debt consolidation?

Yes, risks include potentially extending the loan term, accumulating new debts if spending habits do not change, and hidden fees that might arise during the process.

How can I choose the right consolidation plan?

Evaluate your financial situation, compare loan products, consider your long-term goals, and seek advice from financial professionals to make informed decisions.

Can debt consolidation improve my credit score?

Yes, by consolidating debts and making timely payments, you can improve your credit score and enhance your overall creditworthiness.

What should I avoid during the consolidation process?

Avoid rushing into agreements without thorough research, neglecting to change spending habits, and overlooking the benefits of seeking professional advice.

How can I maintain financial discipline after consolidation?

Set a detailed budget, regularly review your financial progress, and engage with resources to enhance your financial literacy and decision-making skills.

What are some real-life success stories of debt consolidation?

Many individuals have successfully consolidated their debts, leading to financial relief and improved quality of life, such as the inspiring stories of Sarah and Mark.

Connect with us on Facebook!

This Article Was First Found On: https://www.debtconsolidationloans.co.uk

The Article Debt Consolidation Triumphs: Inspiring UK Personal Stories Was Found On https://limitsofstrategy.com

-

Debt Consolidation Strategies to Enhance Confidence in the UK

Your Comprehensive Guide to Achieving Debt Consolidation Mastery in the UK

Understanding the Debt Consolidation Process: A Detailed Overview

Debt consolidation is a strategic financial approach that allows individuals to combine several outstanding debts into a single loan, ideally securing a lower interest rate in the process. This method not only simplifies the monthly repayment process but also significantly improves financial management for those grappling with multiple debts. In the UK, debt consolidation serves as a vital resource for individuals feeling overwhelmed by diverse financial obligations. The typical debts that individuals often consolidate include:

- Credit card debt

- Personal loans

- Overdrafts

- Store card debt

- Payday loans

- Medical bills

- Student loans

This approach not only simplifies the management of multiple debts into a single, manageable payment but also has the potential to generate significant savings on interest payments over time. For countless individuals, engaging in debt consolidation represents an essential turning point, allowing them to reclaim control over their financial situation and paving the way toward a more secure economic future.

Current Trends in the UK Debt Landscape

In recent years, the UK has experienced a concerning surge in consumer debt, with statistics showing that household debt levels have escalated to worrying heights, leaving many individuals feeling overwhelmed by their financial responsibilities. The rising cost of living, coupled with stagnant wage growth, has made it increasingly difficult for individuals to meet their repayment obligations. This challenging backdrop underscores the critical importance of debt consolidation, which can serve as a financial lifeline for those in distress, enabling them to manage their finances in a more effective manner.

Carrying the weight of debt can create a vicious cycle of anxiety and financial instability. Individuals burdened with multiple debts frequently experience increased stress levels, which can detrimentally affect both mental health and daily life. Understanding the current debt landscape emphasizes the urgent need for effective solutions like debt consolidation, which can alleviate this pressure and enhance personal financial management.

Step-by-Step Guide to Debt Consolidation in the UK

In the UK, the process of debt consolidation generally involves obtaining a new loan that is specifically structured to pay off existing debts. This can be accomplished through various channels, including traditional banks, credit unions, or specialized debt consolidation firms. The typical steps involved in this process include:

- Evaluate your current debts and calculate the total amount owed.

- Conduct thorough research to compare available loan options for consolidation.

- Submit an application for the chosen loan, ensuring to carefully review its terms and conditions.

- Use the loan funds to fully pay off your existing debts.

- Begin making regular repayments on your new consolidated loan.

By following these carefully outlined steps, individuals can streamline their financial obligations, making it easier to manage payments while simultaneously reducing the overall burden of interest. This well-structured approach can lead to significant improvements in one’s financial situation over time.

Harnessing the Confidence-Boosting Advantages of Debt Consolidation

Transforming Financial Stability Through Debt Consolidation

Debt consolidation plays an essential role in enhancing financial stability by significantly reducing the complexity involved in managing multiple payments. When individuals have fewer debts to juggle, they can concentrate their efforts on a single repayment plan, which enables more effective budgeting. For many individuals in the UK, transitioning to a consolidated debt strategy has been transformative.

Take the example of Sarah from Manchester, who was struggling under the weight of escalating credit card debt and finding it increasingly difficult to keep up with her payments. After successfully consolidating her debts into a single personal loan with a lower interest rate, she experienced a dramatic reduction in financial stress. This newfound financial stability empowered Sarah to take charge of her finances, significantly boosting her confidence in her budgeting abilities.

Similarly, John, a recent graduate living in London, utilized the debt consolidation approach to effectively manage both his student loans and personal debts. By streamlining his repayment process, he was able to significantly lower his monthly expenses, allowing him to allocate additional funds towards savings and investments. This positive change not only improved his financial outlook but also enhanced his confidence in tackling future financial challenges.

The Psychological Advantages of Debt Consolidation: A Deep Dive

The psychological benefits of debt consolidation extend far beyond mere financial relief. For many individuals, the oppressive weight of debt can lead to heightened stress and anxiety levels. By alleviating this overarching debt burden, consolidation can substantially diminish these negative emotions, thereby promoting improved overall mental well-being. This reduction in stress can lead to a noticeable increase in confidence regarding personal finance management.

Individuals contemplating debt consolidation should not overlook the emotional aspects associated with their financial struggles. Practical steps to consider include setting achievable financial goals post-consolidation and maintaining open communication with creditors. Equipping oneself with knowledge about personal finance can empower individuals, fostering a sense of control over their financial journey.

Additionally, integrating mindfulness practices, such as intentional budgeting and developing awareness of spending habits, can further enhance financial confidence. By adopting a positive attitude towards managing finances, individuals can transform their financial strategies, resulting in lasting psychological benefits over time.

Enhancing Financial Planning Through Debt Consolidation

Once individuals achieve a clearer financial perspective following debt consolidation, they become better positioned to effectively plan for their financial futures. By eliminating the disorder associated with multiple payments, debt consolidation provides a robust foundation for more strategic financial planning. This newfound clarity empowers individuals to allocate their resources towards savings, investments, and other financial goals.

Expert analyses indicate that those who successfully consolidate their debts frequently experience a renewed sense of confidence in their budgeting and saving capabilities. For example, after consolidating his debts, Mark from Birmingham was able to establish a solid savings plan, enabling him to set aside funds for emergencies and future investments. This proactive financial approach significantly bolstered his confidence in managing his finances.

Furthermore, creating a comprehensive financial plan after consolidation can yield substantial long-term benefits. By establishing specific objectives and consistently tracking progress, individuals can cultivate a sense of achievement. This feeling of accomplishment enhances their financial capabilities, solidifying their confidence in addressing future financial challenges.

The Influence of Debt Consolidation on Credit Scores in the UK

Understanding the Relationship Between Debt Consolidation and Credit Scores

The impact of debt consolidation on credit scores can vary depending on the methods utilized. While it can provide significant advantages, it is crucial to comprehend these effects to make informed decisions regarding credit management.

When individuals consolidate their debts, they may observe immediate fluctuations in their credit scores due to factors such as a reduction in credit inquiries and the closure of multiple accounts. However, several important considerations can influence credit scores after consolidating debt:

- Payment history on the new loan

- Changes in the credit utilization ratio

- Length of credit history

- Number of newly opened accounts

When managed properly, debt consolidation can lead to long-term enhancements in credit scores. Individuals who consistently make timely payments on their new consolidated loans can gradually improve their credit profiles, ultimately increasing their confidence regarding their creditworthiness.

Deciphering Credit Utilization in Debt Consolidation

Credit utilization, which is defined as the ratio of credit utilized compared to available credit, plays a vital role in determining credit scores. When individuals opt for debt consolidation, their utilization rates can experience significant changes, which subsequently affects overall credit health. A lower credit utilization ratio is typically viewed favorably by creditors, thus improving credit scores.

For example, if an individual consolidates high credit card balances into a personal loan, their available credit on the credit cards will increase, resulting in a lower utilization ratio. This transformation can lead to a rapid improvement in their credit score, providing a sense of relief and confidence in effective credit management.

Recognizing this relationship is essential for leveraging debt consolidation as a tool to enhance credit scores. Individuals should routinely monitor their credit reports and strive to maintain low utilization ratios, while avoiding new debts and diligently paying down existing obligations. Proactive credit management can create a more favorable financial environment.

Long-Term Credit Effects of Debt Consolidation

Over time, debt consolidation can yield positive long-term effects on credit scores, provided it is managed responsibly. By reducing the number of outstanding debts and ensuring timely repayments, individuals have the potential to repair and enhance their credit ratings gradually.

As credit scores improve, individuals may find it easier to secure loans with more favorable terms in the future. For instance, Emily from Liverpool saw a significant boost in her credit score after consolidating her debts and maintaining consistent payments. This improvement enabled her to qualify for a mortgage with a lower interest rate, further enhancing her confidence in making informed financial decisions.

The long-term benefits of debt consolidation extend beyond just credit scores; they can lead to a comprehensive enhancement in overall financial health, alleviating the anxiety associated with managing debt. Thus, individuals who approach debt consolidation with a long-term strategy can cultivate lasting confidence in their financial dealings.

The Significance of Payment History After Debt Consolidation

Payment history is a critical factor in determining any credit score, accounting for a substantial portion of the overall evaluation. Following debt consolidation, it is essential to maintain a timely payment schedule on the new consolidated loan to preserve and enhance credit scores. Consistent on-time payments reflect responsible credit management and can positively influence credit scores over time.

To ensure timely payments, individuals should consider setting reminders or automating payments. For example, James from Edinburgh successfully improved his credit score by establishing automatic payments for his consolidated loan, thus helping him maintain an impeccable payment history. This proactive strategy not only increased his confidence in managing finances but also opened new avenues for obtaining credit.

Conversely, missing payments can adversely affect credit scores, underscoring the importance of adhering to payment schedules. By prioritizing timely repayments, individuals can effectively manage their credit scores and nurture greater confidence in their financial capabilities.

Exploring Debt Consolidation Options in the UK

Available Types of Debt Consolidation Loans: A Comprehensive Overview

In the UK, various options exist for debt consolidation, primarily categorized into secured and unsecured loans. Each type carries its own advantages and risks, making it essential for individuals to thoroughly understand these options before proceeding.

Secured loans are backed by collateral, typically a property, which can result in lower interest rates. However, there is a risk of losing the asset if repayments are not met. The benefits of secured loans include:

- Lower interest rates due to reduced risk for lenders

- Higher borrowing limits

- Longer repayment periods

Conversely, unsecured loans do not require collateral, but they typically come with higher interest rates. The advantages of unsecured loans include:

- No risk of losing an asset

- Faster approval processes

- Ideal for individuals without substantial assets

Gaining a clear understanding of the advantages and disadvantages of each loan type is crucial for selecting the most suitable path for debt consolidation, ensuring alignment with personal financial situations and objectives.

Structuring Debt Management Plans in the UK

Debt management plans (DMPs) represent an alternative for individuals struggling with debt, especially when traditional debt consolidation may not be feasible. In the UK, a DMP involves collaborating with a credit counseling agency to negotiate payment arrangements with creditors. This approach can effectively consolidate debts and restore financial confidence.

When entering a DMP, the credit counselor evaluates the individual’s financial situation and proposes a manageable monthly payment plan to creditors. This method often results in reduced payments and the potential for interest freezes on debts. Participants in DMPs can experience considerable relief from financial stress, allowing them to focus on a single, manageable payment instead of juggling numerous debts.

Partnering with a credit counselor not only assists in debt management but also equips individuals with invaluable financial education, empowering them to make informed financial decisions as they move forward.

The Role of Home Equity Loans in Debt Consolidation

Home equity loans can serve as a powerful tool for debt consolidation, enabling individuals to leverage the equity built up in their properties. By utilizing funds from a home equity loan to pay off unsecured debts, homeowners can potentially secure lower interest rates, resulting in significant savings.

However, it is crucial to recognize the risks associated with home equity loans. The primary concern is the possibility of losing one’s home if repayments are not consistently met. Individuals considering this option must engage in thorough research, ensuring they fully comprehend the terms and their ability to manage repayments over the long term.

When incorporated into a broader debt consolidation strategy, home equity loans can yield positive outcomes, provided homeowners adhere to a responsible repayment schedule, thereby enhancing their financial stability and confidence.

Building Confidence Through Debt Consolidation in the UK

The Immediate Benefits of Debt Consolidation Explained

The immediate advantages of debt consolidation can be transformative, offering individuals a sense of relief and renewed confidence in managing their finances. By streamlining monthly payments and potentially securing lower interest rates, individuals often experience a rapid alleviation of financial stress.

This instant relief frequently translates into an immediate boost in confidence as individuals regain control over their financial obligations. For instance, after consolidating her debts, Laura from Bristol reported a newfound sense of freedom, enabling her to focus on long-term financial planning rather than feeling overwhelmed by multiple payments.

Additionally, the clarity afforded by a single consolidated payment empowers individuals to allocate funds more effectively, promoting improved budgeting practices. This heightened financial awareness can further reinforce confidence, empowering individuals to take charge of their financial futures.

Fostering Long-Term Confidence Through Debt Consolidation

Debt consolidation lays the groundwork for long-term confidence by establishing a clear path toward achieving a debt-free status. By instituting manageable repayment schedules and eliminating the confusion associated with multiple debts, individuals can cultivate a more organized approach to their finances.

As individuals observe progress toward their financial goals, such as reducing overall debt and improving credit scores, their confidence in managing their finances naturally increases. This long-term perspective nurtures a sustainable sense of control over financial situations.

For example, Mark in Sheffield, who consolidated his debts three years ago, has successfully eliminated his debt and improved his credit score. This journey not only solidified his confidence in financial management but also inspired him to explore new investment opportunities.

Ultimately, the clarity and control gained through debt consolidation can empower individuals to confront future financial challenges with confidence and resilience.

Strengthening Confidence Through Financial Education

Integrating debt consolidation with financial education can significantly enhance overall understanding of personal finance, consequently boosting confidence. When individuals grasp the fundamentals of budgeting, saving, and investing, they become better prepared to manage their financial situations effectively.

Acquiring knowledge about personal finance can involve attending workshops, reading relevant literature, or collaborating with financial advisors. For instance, engaging in a financial literacy program after debt consolidation can equip individuals with the essential skills needed to maintain long-term financial health.

As individuals accumulate knowledge, their confidence in making financial decisions strengthens. This newfound empowerment can result in more positive financial behaviors, such as consistent saving and informed investing. Consequently, this creates a virtuous cycle, reinforcing confidence and fostering sustainable financial success.

Research Findings on Debt Consolidation and Confidence Enhancement

The Correlation Between Debt Consolidation and Confidence: Research Insights

Research underscores a robust correlation between debt consolidation and improved mental health, which subsequently enhances confidence. Studies have demonstrated that individuals who successfully consolidate their debts report lower levels of stress and anxiety, contributing to enhanced overall well-being.

The act of consolidating debt can instill a sense of accomplishment, as individuals take proactive steps toward managing their financial situations. By simplifying financial obligations and lowering monthly payments, debt consolidation alleviates feelings of overwhelm, resulting in increased confidence and emotional stability.

Moreover, the positive outcomes associated with debt consolidation extend beyond financial relief. Individuals often report higher levels of life satisfaction and improved self-esteem, as their ability to manage finances becomes more attainable. This connection highlights the significance of considering the emotional dimensions of debt when evaluating consolidation options.

Measuring Success Rates in Debt Consolidation

Success rates for debt consolidation can be evaluated through various metrics, including debt reduction and improvements in credit scores. Many individuals who have pursued debt consolidation manage to significantly lower their overall debt levels, leading to enhanced financial stability.

For example, a study conducted among UK residents who consolidated their debts indicated that over 70% reported a decrease in their overall debt within a year of consolidation. Additionally, many participants experienced improvements in credit scores, further validating the effectiveness of debt consolidation as a viable financial strategy.

Real-world examples reinforce these findings, as individuals like Rachel from Newcastle successfully consolidated her debts and reduced her total debt by 40% within 18 months. These statistics illustrate the potential of debt consolidation to facilitate financial recovery, instilling confidence in individuals to make informed financial choices.

The Overall Impact of Debt Consolidation on Well-Being

Beyond mere financial metrics, debt consolidation profoundly influences individuals’ overall well-being. By alleviating the stress associated with multiple debts, individuals often experience significant enhancements in mental health and life satisfaction.

Many report improved relationships, as financial burdens lift, allowing for better communication and reduced anxiety within family dynamics. This holistic improvement highlights the broader implications of debt management on personal lives.

Recognizing the positive influence of debt consolidation on overall well-being is crucial for those contemplating this option. By understanding the potential benefits, individuals can make informed decisions that not only support their financial goals but also contribute to an improved quality of life and overall well-being.

Strategic Budgeting Post-Debt Consolidation: Elevating Financial Management in the UK

Refining Budgeting Practices Through Debt Consolidation

Debt consolidation can significantly enhance budgeting practices by streamlining the repayment process. By combining multiple payments into one monthly obligation, individuals can simplify their budgeting efforts, leading to more effective financial management.

With fewer financial responsibilities to monitor, individuals can allocate their remaining funds toward essential expenses, savings, or investments. This clarity fosters a proactive approach to budgeting, enabling individuals to identify areas for potential savings.

Moreover, the potential for lower monthly repayments associated with debt consolidation can free up additional funds. For instance, after her debt consolidation, Emma from Liverpool was able to redirect her savings toward her emergency fund, thereby improving her financial security and confidence.

In essence, the simplification of budgeting through debt consolidation lays the groundwork for improved financial practices, nurturing a greater sense of control over personal finances.

Implementing Effective Budgeting Strategies Following Debt Consolidation

After successfully consolidating debt, implementing effective budgeting strategies is crucial for maintaining financial stability. Key strategies to consider include:

- Establish a clear monthly budget that reflects the new payment structure.

- Monitor all expenses to identify unnecessary spending.

- Set financial goals for saving and investing.

- Regularly review and adjust the budget to adapt to changes.

By employing these strategies, individuals can navigate their financial circumstances with increased confidence. For instance, establishing specific savings goals post-consolidation allows individuals to concentrate on future financial objectives, reinforcing their commitment to responsible money management.

Regularly evaluating spending habits and adjusting budgets as needed can help maintain a healthy financial trajectory, ensuring that the advantages of debt consolidation are preserved over time. Ultimately, adopting sound budgeting practices fosters confidence, empowering individuals to achieve their financial aspirations.

The Importance of Establishing Emergency Funds After Debt Consolidation

Creating an emergency fund after debt consolidation is essential for achieving long-term financial health. A financial safety net provides individuals with peace of mind, ensuring preparedness for unexpected expenses. This readiness significantly enhances confidence in managing future financial challenges.

An adequately structured emergency fund should ideally cover three to six months’ worth of living expenses. This buffer allows individuals to navigate financial setbacks without resorting to additional debt. For instance, after consolidating her debt, Sophie from Cardiff prioritized establishing an emergency fund, which proved invaluable when unexpected expenses arose.

Furthermore, having an emergency fund alleviates anxiety associated with financial uncertainty, enabling individuals to focus on their long-term goals. By recognizing the significance of this financial cushion, individuals can create a solid foundation for their financial future, reinforcing their confidence in money management.

Choosing the Right Debt Consolidation Option in the UK

Selecting the appropriate debt consolidation approach in the UK is critical for effective debt management. Key factors to contemplate include interest rates, fees, and personal financial goals.

Individuals should begin by assessing their current financial circumstances and comparing various consolidation options. This includes evaluating both secured and unsecured loans, as well as exploring alternative methods such as debt management plans.

Additionally, it is essential to consider personal situations, such as credit scores and income levels, when choosing a consolidation option. Conducting thorough research can aid individuals in making informed decisions that align with their financial objectives.

By carefully weighing the pros and cons of each choice, individuals can tailor their debt consolidation strategies to effectively manage debt and pave the way for a more confident financial future.

The Role of Financial Advisors in Debt Consolidation and Budgeting

Financial advisors can play a pivotal role in guiding individuals through the debt consolidation process and establishing effective budgeting strategies. Their expertise provides invaluable insights into selecting the most appropriate consolidation options based on individual circumstances.

Collaborating with a financial advisor enables individuals to gain a deeper understanding of their financial situations and develop customized strategies for debt management. For instance, a financial advisor can assist in formulating a comprehensive budget that accommodates the new consolidated payment while prioritizing savings and investments.

Moreover, financial advisors offer ongoing support, helping individuals stay focused on their financial goals and adapt strategies as necessary. This guidance fosters a greater sense of confidence in managing personal finances, ensuring that individuals are empowered to navigate their financial futures effectively.

The Interplay Between Debt Consolidation and Savings in the UK

Enhancing Savings Through Debt Consolidation

Debt consolidation can lead to increased savings by lowering interest rates and simplifying payment structures. By consolidating debts, individuals frequently secure lower interest rates, resulting in reduced monthly payments. This decrease allows individuals to allocate the freed-up funds toward savings objectives.

For example, after consolidating his debts, Alex from Leeds was able to save £100 each month that had previously gone towards high-interest repayments. By redirecting these funds into a savings account, he quickly built a financial cushion, thereby boosting his overall financial confidence.

Additionally, the clarity achieved through a single payment structure enables individuals to budget more efficiently, further promoting savings. By prioritizing savings alongside debt repayment, individuals can create a healthier financial foundation, reinforcing their confidence in managing their finances.

Optimal Saving Strategies Following Debt Consolidation

Implementing effective saving strategies after debt consolidation is crucial for establishing financial security. Key strategies include:

- Define specific savings goals, such as emergency funds or holiday savings.

- Automate savings contributions to ensure consistency.

- Review and trim unnecessary expenses to redirect funds towards savings.

- Utilize high-interest savings accounts to grow savings effectively.

By employing these strategies, individuals can maximize their savings potential and create a sense of financial stability. For instance, automating monthly savings contributions guarantees that funds are consistently set aside, contributing toward specific goals.

Furthermore, regularly reassessing expenses enables individuals to identify areas for potential savings, reinforcing their commitment to responsible financial management. By merging debt consolidation with proactive savings strategies, individuals can elevate their financial confidence and security.

The Connection Between Debt Consolidation and Retirement Planning

Debt consolidation can act as a catalyst for improved retirement planning by freeing up funds for retirement savings. By alleviating high-interest debts, individuals can redirect their financial resources toward retirement accounts, thereby ensuring a more secure future.

Understanding the connection between debt management and retirement planning is crucial for fostering long-term financial confidence. For instance, Jennifer from Brighton, who consolidated her debts, was able to increase her contributions to her pension scheme, significantly boosting her retirement savings.

Moreover, the financial stability gained through debt consolidation empowers individuals to make informed decisions regarding their retirement plans. As individuals take control of their debt, they can develop a clearer vision for their financial future, enhancing their confidence in their retirement readiness.

The Future Landscape of Debt Consolidation in the UK

Transformations in the Debt Consolidation Industry

The debt consolidation sector in the UK is continuously evolving, with new products and services emerging to meet changing consumer demands. As financial institutions adapt to the needs of a modern economy, individuals can access innovative solutions that simplify the debt consolidation process.

Staying informed about these developments is vital for individuals seeking to manage their debts effectively. By keeping up with the latest trends in debt consolidation, individuals can make informed decisions that align with their financial goals, ultimately boosting their confidence in navigating personal finance.

The Influence of Technology on Debt Consolidation

Technology plays an increasingly pivotal role in debt consolidation, with online applications and financial management tools enhancing accessibility like never before. Digital platforms allow individuals to compare loan options, assess their financial situations, and apply for debt consolidation loans with ease.

Moreover, technology supports budgeting and expense tracking, empowering individuals to manage their finances more effectively. For instance, budgeting apps can provide insights into spending habits, enabling users to identify areas for potential savings after consolidation. By embracing technological advancements, individuals can boost their financial literacy and confidence, streamlining their debt management journey.

The Importance of Staying Informed to Maintain Confidence

Remaining informed about debt consolidation options and strategies is crucial for sustaining confidence in financial management. By understanding the nuances of debt consolidation, individuals can navigate their financial journeys with clarity and purpose.

Regularly reviewing financial situations, exploring new consolidation options, and engaging with financial education resources can empower individuals to make informed decisions. This knowledge not only enhances confidence but also cultivates a proactive approach to managing finances, helping individuals establish a more stable financial future.

Regulatory Changes Affecting Debt Consolidation Practices

As the financial landscape evolves, regulatory changes can significantly impact debt consolidation practices. Staying updated on these changes is essential for individuals aiming to manage their debts effectively.

Understanding how regulations influence interest rates, lending practices, and consumer protections can equip individuals to make informed decisions regarding debt consolidation. By remaining aware of the regulatory environment, individuals can navigate the complexities of personal finance with confidence and agility.

Enhancing Financial Outcomes Through Personalized Debt Consolidation Strategies

Tailoring debt consolidation strategies to individual needs can significantly improve financial results. By considering personal circumstances, such as income levels, credit scores, and financial goals, individuals can create customized plans that align with their unique situations.

Consulting with financial advisors can provide valuable insights into developing personalized strategies, empowering individuals to manage their debts more effectively. Tailoring debt consolidation approaches not only maximizes financial outcomes but also reinforces confidence in personal finance management.

Frequently Asked Questions About Debt Consolidation

What is the Definition of Debt Consolidation?

Debt consolidation refers to the process of merging multiple debts into a single loan, typically at a lower interest rate, with the goal of simplifying repayments and reducing financial stress.

How Does Debt Consolidation Enhance Confidence?

Debt consolidation boosts confidence by simplifying financial management, alleviating stress associated with multiple debts, and providing a clear pathway to achieving a debt-free status.

What Types of Debt Can Be Consolidated?

Common types of debt that can be consolidated include credit card debt, personal loans, overdrafts, store card debt, and student loans.

What Impact Does Debt Consolidation Have on Credit Scores?

Debt consolidation can positively affect credit scores if managed appropriately, primarily through improved payment history and reduced credit utilization ratios.

Are There Risks Associated with Debt Consolidation?

Yes, risks include the potential loss of collateral with secured loans and the possibility of accruing new debt if budgeting is not effectively managed.

What Are Debt Management Plans?

Debt management plans are agreements between individuals and creditors, often facilitated by credit counseling agencies, to establish manageable repayment schedules.

How Can I Determine the Right Debt Consolidation Method?

Choosing the appropriate method involves evaluating your financial situation, comparing interest rates, and considering personal financial goals.

What Role Do Financial Advisors Have in Debt Consolidation?

Financial advisors provide expert guidance on debt consolidation options, budgeting strategies, and financial education to empower individuals in effectively managing their debts.

How Can Debt Consolidation Lead to Increased Savings?

Debt consolidation can promote increased savings by lowering interest rates and streamlining payments, allowing individuals to redirect surplus funds toward savings objectives.

What Are the Optimal Budgeting Strategies After Debt Consolidation?

Effective budgeting strategies include establishing specific savings goals, tracking expenses, and regularly reviewing and adjusting budgets to reflect new financial realities.

Connect with us on Facebook!

This Article Was First Found On: https://www.debtconsolidationloans.co.uk

The Article Debt Consolidation: Boosting Confidence in the UK Was Found On https://limitsofstrategy.com

-

Content Creation Strategies for Small Businesses in Chard

Boosting Community Engagement Through Tailored Content Creation in Chard

Understanding the Core of Chard Content

Chard content embodies a strategic approach to developing a variety of materials specifically designed for the vibrant town of Chard in Somerset. This approach requires an in-depth understanding of the local culture and the unique preferences of the residents. By focusing on these aspects, businesses can create content that resonates with the community on a profound level. Authentic Chard content encapsulates the town’s unique character, addresses the interests of local residents, and engages them in meaningful ways. Essential components of effective Chard content include:

- Alignment with local events and news to stay relevant

- Incorporation of local dialects and cultural references for relatability

- Showcasing local businesses and community stories to build connections

- Use of local imagery and notable landmarks to enhance authenticity

- Engagement with community concerns and interests for dialogue

- Promotion of local culture and heritage to foster pride

- Encouragement of community involvement and feedback to enhance engagement

By recognizing and leveraging these critical elements, businesses in Chard can create captivating narratives that not only attract their audience but also cultivate a strong sense of community unity.

Unveiling the Advantages of Targeted Localised Content Strategies

The creation of localised content can dramatically improve engagement levels and conversion rates, establishing a genuine connection with the Chard community. This bespoke approach fosters trust among residents, reflecting a deep understanding of their needs and aspirations. The extensive benefits of localised content include:

- Increased customer loyalty and trust through relatable messaging

- Boosted engagement rates across social media platforms

- Improved brand visibility within the local community

- Optimised local search engine optimisation (SEO) for better discoverability

- Strengthened community relationships and support networks

- Higher conversion rates resulting from targeted local traffic

- Greater influence on local purchasing choices, driven by community connection

When businesses produce content that speaks directly to the Chard community, they position themselves as essential parts of the local landscape, which is crucial for sustainable growth and success.

Essential Tools for Creating Engaging Chard Content

A diverse array of tools can streamline the process of producing impactful Chard content, from social media platforms to local advertising channels. It’s critical to choose the right tools that align with your business objectives and target audience. Recommended tools for developing Chard content include:

- Canva for designing visually appealing graphics that capture attention

- Hootsuite for scheduling and managing social media posts efficiently

- Google Analytics for tracking website performance and user behaviour

- Mailchimp for executing targeted email marketing campaigns

- Buffer for social media analytics and enhancing audience engagement

- Local SEO tools such as Moz for improving search visibility

- WordPress for creating and managing blog content effectively

By effectively utilizing these tools, small businesses in Chard can produce high-quality, engaging content that captivates their local audience and enhances their overall digital presence.

Expert Insights on Content Creation Strategies for Small Businesses in Chard

Effective Ways to Integrate Local Culture into Your Content

Incorporating local culture into your content is essential for ensuring it resonates with and engages the residents of Chard. To achieve this, consider embedding local events, traditions, and notable landmarks into your narratives. Here are actionable steps to seamlessly incorporate local culture:

1. Research local history and traditions: Delve into the unique aspects of Chard’s culture, including historical events or annual festivals, and weave these elements into your content.

2. Attend local events: Engage in community gatherings to gain insights into the interests and values of residents, which can enrich your content creation process.

3. Feature local personalities: Highlight local figures such as artists, business owners, or community leaders in your stories to foster a sense of connection and authenticity.

4. Utilise local slang or dialects: Infusing local language nuances can significantly enhance the relatability and engagement of your content for Chard residents.

5. Share community stories: Craft narratives that focus on local heroes, community initiatives, or inspiring tales from within Chard.By following these steps, businesses can develop content that resonates deeply with the local audience while reflecting the rich tapestry of Chard’s cultural identity.

What Makes Chard Content Unique Compared to Generic Alternatives?

Chard content distinguishes itself through its focus on local issues, events, and the vibrant community spirit. Businesses that successfully harness the essence of Chard can create content specifically tailored to the interests and needs of its residents. The uniqueness of Chard content stems from its deep-rooted connection to the local environment and community. Expert analysis highlights several key factors that differentiate Chard content from generic options:

1. Local relevance: Unlike generic content, Chard content caters to the specific needs and interests of the community, ensuring a deeper resonance with the audience.

2. Community engagement: Chard content fosters dialogue between businesses and residents, promoting feedback and collaboration that strengthens community ties.

3. Cultural reflection: Effective Chard content mirrors the cultural nuances of the town, creating a sense of belonging for residents who see their lives reflected in the narratives.

4. Support for local initiatives: Content that promotes local businesses, charities, and events contributes to a vibrant community spirit and encourages residents to support one another.By concentrating on these unique aspects, businesses can position their content as vital contributions to Chard’s community narrative, enhancing their brand reputation and customer loyalty.

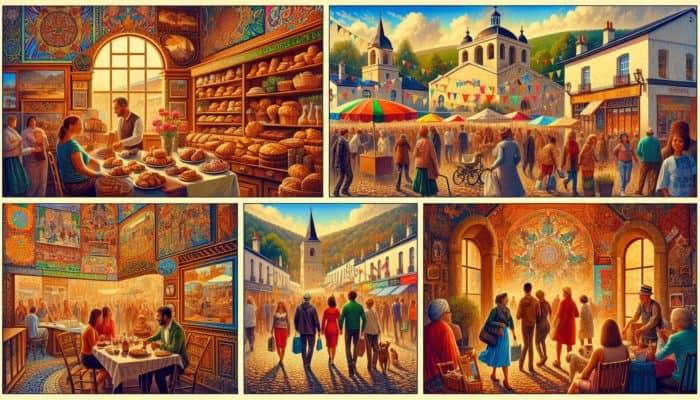

Real-Life Examples of Successful Content Campaigns in Chard

Examining successful content campaigns in Chard provides invaluable insights into effective content strategies. Businesses that have successfully engaged the local community often share common characteristics in their content approach. Here are real-world examples of effective Chard content:

1. A local bakery’s community story: A bakery in Chard documented its journey from a small establishment to a beloved community hub through a blog series. By sharing customer stories and detailing local sourcing efforts, they attracted a dedicated following and engaged the community.