Your cart is currently empty!

Proven Techniques to Effectively Manage Debt While Facing Furlough

Proven Techniques to Effectively Manage Debt While Facing Furlough

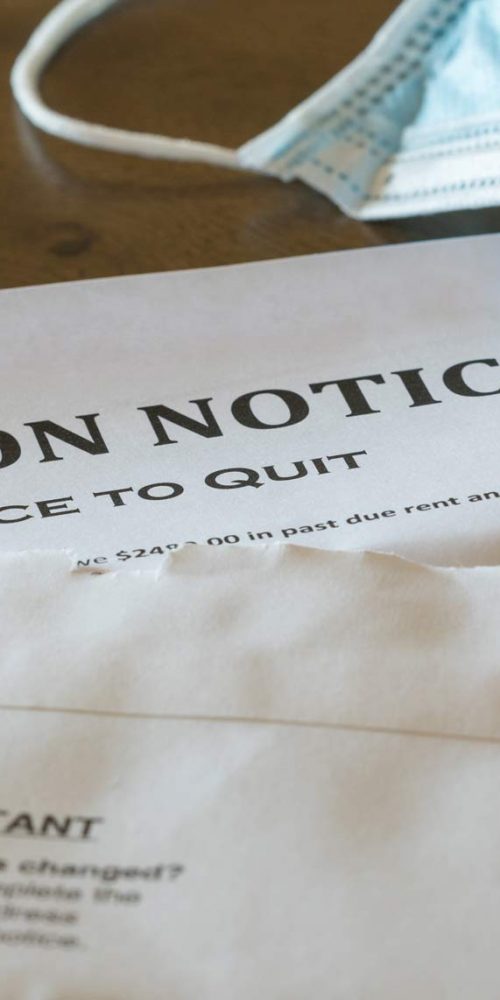

The COVID-19 pandemic has had a profound effect on the UK economy, leading to a wave of furloughs and layoffs across multiple sectors. As a result, countless individuals are grappling with severe financial challenges and the overwhelming burden of managing their existing debts with significantly reduced income. If you find yourself in a prolonged furlough situation, the prospect of handling your debts can be particularly intimidating, especially when your income is reduced to 80% of your usual salary. However, navigating through this financial turmoil is entirely possible by implementing practical strategies designed to manage and ultimately eliminate your debts. Here’s a guide on how you can regain control of your financial situation during these challenging times and work towards a stable recovery.

1. Develop a Tailored Monthly Budget Reflecting Your Adjusted Income

Start by crafting a revised monthly budget that accurately reflects your current financial circumstances. This budget must consider your diminished income while also emphasizing your capacity to save. Take the time to re-evaluate your spending habits and think about reallocating funds from non-essential areas such as entertainment, dining out, and luxury purchases towards your necessary bills and savings. By putting your financial responsibilities first and cutting back on discretionary spending, you can create a sustainable budget that empowers you to manage your debts more effectively while also preparing for any potential future financial hurdles that may arise.

2. Explore Additional Income Opportunities to Compensate for Pay Cuts

To meet your debt repayment obligations, it is crucial to find ways to make up for the 20% salary shortfall. Look for alternative income sources, such as freelance gigs or part-time employment, and consider trimming your expenses by canceling subscriptions you rarely use or reassessing your grocery shopping strategies. Implementing a cost-effective meal plan can significantly decrease your monthly outlay. By actively seeking these additional income streams and making smart savings choices, you will be in a stronger position to meet your debt obligations and avoid falling behind during your period of furlough.

3. Explore Debt Consolidation Loans to Streamline Your Financial Payments

Consider the option of applying for debt consolidation loans for bad credit. These financial products can simplify your repayment process by merging various debts into a single, manageable monthly payment. This method can reduce the complexity associated with remembering multiple due dates and payment amounts, thereby making financial planning more straightforward. For individuals currently on furlough, a <a href="https://limitsofstrategy.com/debt-consolidation-loan-calculator-for-effective-budgeting/">debt consolidation loan</a> can provide a structured approach to effectively manage a limited income while alleviating the stress of juggling various payments, ultimately helping you to regain your financial stability.

4. Strategically Plan for Your Future Financial Goals and Security

As you navigate your financial landscape, it’s important to keep your long-term goals in sight, such as buying a home or launching your own business. Establishing these objectives can serve as a powerful motivator to improve your overall financial health. A debt consolidation loan can also play a significant role in enhancing your credit score, making it easier for you to qualify for a mortgage or business loan with favorable terms. By engaging in strategic planning and working diligently towards your financial aspirations, you can position yourself for success and achieve greater financial independence over time.

For further assistance and expert guidance on managing your finances during these uncertain times, including insights on how debt consolidation loans can specifically benefit furloughed employees, reach out to Debt Consolidation Loans today.

Comments

2 responses to “Furloughed and in Debt? Essential Steps to Take Now”

The challenges posed by furloughs are certainly daunting, and your insights on managing debt during these times resonate with so many of us. I can relate to the stress that comes with adjusting to an income that no longer covers our usual expenses. Crafting a tailored budget sounds essential, and I’ve found that it’s a really grounding exercise. It not only clarifies my priorities but also helps me identify areas where I can cut back.

Thank you for shedding light on a topic that resonates with so many of us during these uncertain times. The financial implications of furlough can indeed be daunting, and as you suggested, developing a monthly budget that reflects our adjusted income is crucial. I’ve personally found that not only does this practice help in monitoring expenses, but it also provides a sense of control over a situation that feels largely out of our hands.